Economic data tells us that we are in the later part of the business cycle. That is, in a bull market that is doing well and supported by a pro-business government. In fact, The International Monetary Fund calls our current times the “broadest synchronized global growth upsurge since 2010,” and is predicting that the active investing pattern will continue with an almost 4% growth this year and in 2019.

If you have been active investing throughout the cycle, then the value of your portfolio is likely on the rise. But if you haven’t been investing, is it too late to reap the benefits of this cycle? How can Stableford Capital help you use active investing late in the business cycle to grow your assets, without too much risk?

Knowing the Cycle

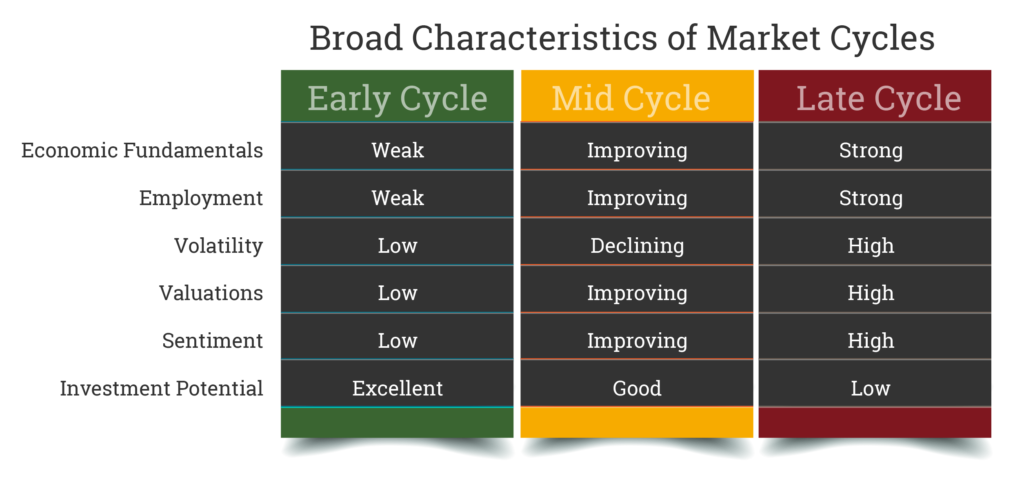

Before we can truly take advantage of late cycle investing, we have to determine that we are actually late in the business cycle. Stableford looks for five key elements that typically describe a cycle in it’s third act: economic fundamentals, strong employment/low unemployment rates, high volitilioty, high valuations, high investor sentiment and low investment potential. Late cycle assets will likely be on the rise, as well, like commodities (i.e. gold) and comodity-related stocks.

In comparison, if we were early in the business cycle, these elements would be different. We would expect that employment would be weak, and volatility, valuations and investor sentiment would be low (and thus investment potential high). Progressing into mid-cycle means employment would be improving, along with valuations and investor sentiment. But investment potential would be lower.

In comparison, if we were early in the business cycle, these elements would be different. We would expect that employment would be weak, and volatility, valuations and investor sentiment would be low (and thus investment potential high). Progressing into mid-cycle means employment would be improving, along with valuations and investor sentiment. But investment potential would be lower.

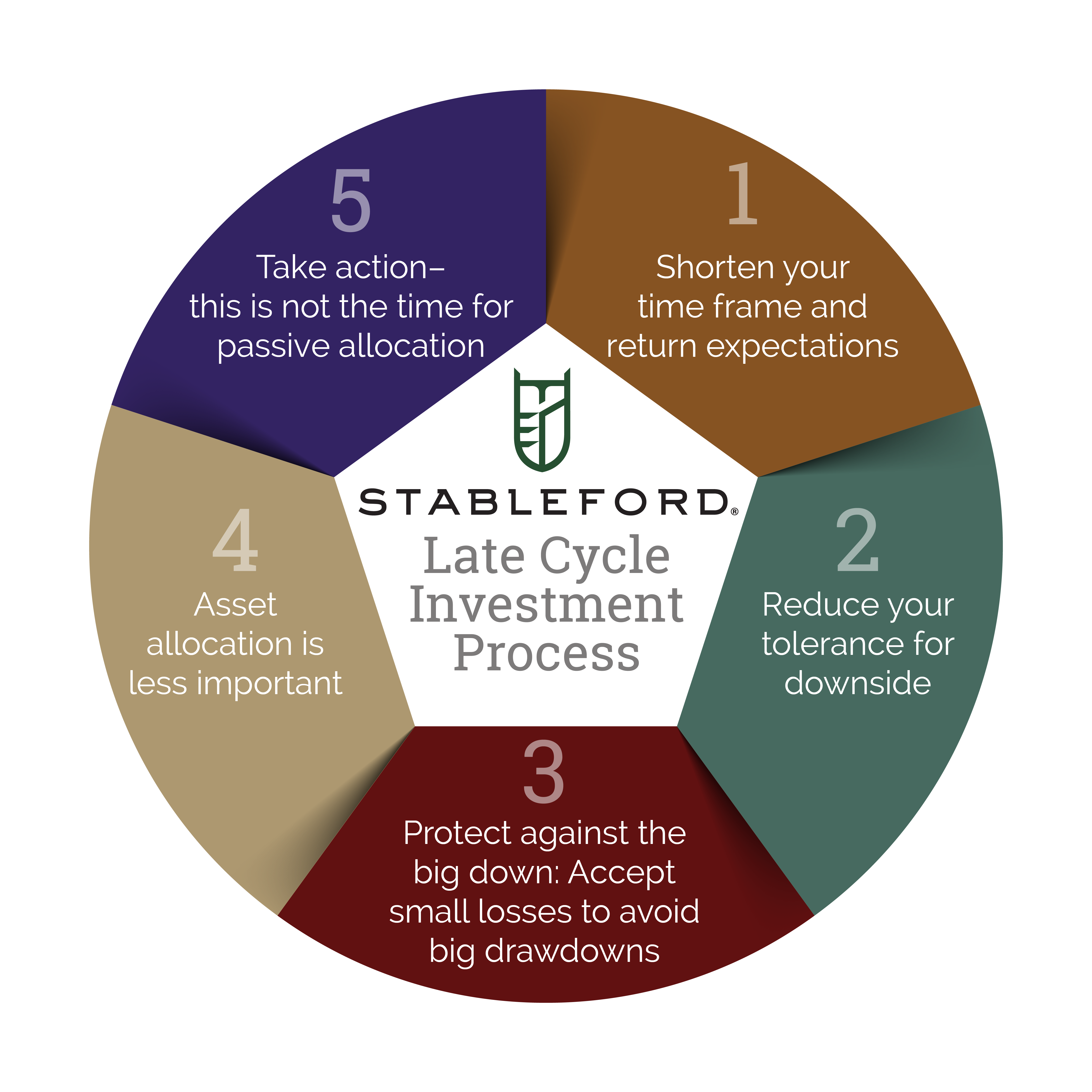

Recognizing the cycle is the key to risk adjusted returns. The late cycle investment process focuses a lot more on risk management. Understanding the five stages of the strategy means that this is not the time to, ‘stay the course’ – you need to have a proactive plan.

Protecting and growing wealth in a more volatile market that is late in the cycle is part of the active investing process that Stableford is known for.

Stableford Capital’s 7-Steps for Late Cycle Portfolio Active Investing

Dubbed our “Magnificent 7,” the Stableford 50+ will do these seven active investing processes dynamically when late in the business cycle.

1. Boost cash. Sometimes a mere 1% yield on a three-month Treasury bill will have to be enough. It’s important to not discount the capital appreciation of a Treasury bill in a slow growth economy.

2. Limit the overall economy’s influence on stock exposure. For example, choose stocks like Proctor and Gamble – stocks that are household goods and used throughout the year – instead of automotive-related stocks that are more cyclical in nature.

3. Shift your focus. Focus on companies with strong balance sheets, low refinancing risks and free cash flow.

4. Reduce the beta. A beta measures the systematic risk of a portfolio, as compared to the market. Late in the cycle, a beta of less than 1 on an equity portfolio is preferred, meaning that the security is less volatile than the market. If the beta is greater than 1, the security’s price could be more volatile than the market.

5. Earnings quality and predictability weigh more. The quality of earning refers to the amount of earnings attributable to higher sales or lower costs rather than artificial or engineered profits.

6. Increase investments in dividend growth and yield. Also step up investments in less economically-sensitive parts of the market. Dividends send a clear message about future prospects and performance – steady dividends over time and the ability to increase them provide good clues about corporate fundamentals.

7. Keep an eye on long-term bond yields. Long-term bond yields never rise during a recession, even zero coupon, but they can always go lower. Both short-term and long-term bonds can be a strong predictor of the economic future, including future levels of inflation.

When it comes to active investing late in the business cycle, it takes knowledge to recognize the cycle and the experience to react. Stableford’s Magnificent 7 late cycle portfolio investing process looks at every component of the market and your asset allocation to help grow your wealth at any point in the cycle. It’s important to act quickly late in the cycle, as you can’t predict exactly when the curtain will fall. To step up your investments and protect your portfolio for the next cycle, contact a Stableford wealth advisor today at 480.493.2300.