The Business Roundtable came out with a statement that corporations also have responsibilities to customers, employees, communities and suppliers. That statement sparked quite a bit of debate about why corporations shouldn’t just ONLY be responsible to the owners/shareholders.

At Stableford, the ideas brought up a lot of debate – and we got response from our clients, too about the rights of public company shareholders.

Here’s the meat of the statement from the Roundtable.

While each of our individual companies serves its own corporate purpose, we share a fundamental commitment to all of our stakeholders. We commit to:

Delivering value to our customers. We will further the tradition of American companies leading the way in meeting or exceeding customer expectations.

Investing in our employees. This starts with compensating them fairly and providing important benefits. It also includes supporting them through training and education that help develop new skills for a rapidly changing world. We foster diversity and inclusion, dignity and respect.

Dealing fairly and ethically with our suppliers. We are dedicated to serving as good partners to the other companies, large and small, that help us meet our missions.

Supporting the communities in which we work. We respect the people in our communities and protect the environment by embracing sustainable practices across our businesses.

Generating long-term value for shareholders, who provide the capital that allows companies to invest, grow and innovate. We are committed to transparency and effective engagement with shareholders.

In the interest of sparking more debate … here are some questions thrown out at Stableford. What do you think?

What About Public Company Shareholder Rights?

The Roundtable’s statement basically dilutes the primary rights and powers of the shareholders – the risk-takers who actually own the company. These are the folks who risk their own capital because they believed in the future and vision of the corporation.

By putting up other parties as EQUALS, doesn’t that mean that the shareholders are being left behind?

We can quote Milton Friedman:

“In a free-enterprise, private-property system, a corporate executive is an employee of the owners of the business. He has direct responsibility to his employers. That responsibility is to conduct the business in accordance with their desires…the key point is that, in his capacity as a corporate executive, the manager is the agent of the individuals who own the corporation…and his primary responsibility is to them.”

Friedman argues that an executive spending company money on “social causes” is, in effect, spending somebody else’s money for their own purposes:

“Insofar as [a business executive’s] actions in accord with his ‘social responsibility’ reduce returns to stockholders, he is spending their money. Insofar as his actions raise the price to customers, he is spending the customers’ money. Insofar as his actions lower the wages of some employees, he is spending their money.” He argues that the appropriate agents of social causes are individuals—”The stockholders or the customers or the employees could separately spend their own money on the particular action if they wished to do so.

* Can a CEO Serve Two Masters? Or Three or More?

Serving two masters is very difficult – just ask the average office administrator who must please multiple bosses while keeping an office running smoothly.

A corporate leader cannot please all of these parties – the owners, the community, employees and supplies – without creating chaos and ruin. Let’s just pick one master to follow, and make that the lodestar for the company’s vision.

* Why Not Ask for a Public Pledge?

Friedman argues that the best and most appropriate agents to make a difference in society are individuals.

The Roundtable is made up of individuals (ie CEOs who have astronomical amounts of personal wealth and assets.) Why doesn’t the Roundtable make a statement urging these CEOs – and other C-suite executives – to publicly pledge their wealth for doing good?

*Why not address the huge CEO pay gap?

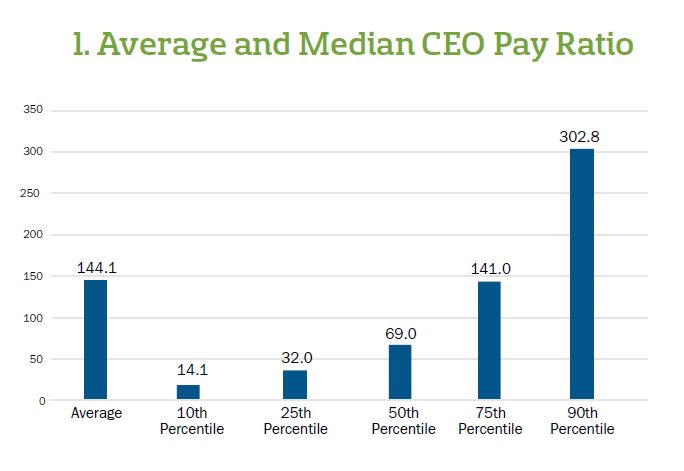

Let’s just take a look at the gap in the pay between CEOs of the largest corporations and the median pay (also known as the CEO Pay Ratio). The largest corporations now have a gap between the CEO pay and their median employee pay – by a ratio of nearly 300 to 1.

CEO PAY RATIO: THE TOTAL ANNUAL COMPENSATION OF THE MEDIAN EMPLOYEE OF THE ORGANIZATION, AND THE RATIO BETWEEN THE TWO

A gap like that cannot be healthy for corporations in the long run. Or, for that matter, for a community and country.

Why not advocate a way to reward hard-working employees, boost morale and help out your local community’s economy – via higher wages for the employees?

Just think about the social impact of providing live-able wages for employees who must scrape by, living from paycheck to paycheck. These workers are forced to rely on subsidies from state and federal government (in the form of health care, food stamps and the like) to survive. As the cost of housing skyrockets, we are seeing a boost in homelessness among working families who cannot afford even basic apartment rents in metropolitan areas in the U.S.

The higher wages would help to reduce the tax burden on state and local governments, which are dealing with the social costs of such low wages. Higher wages would also boost the local economy, bringing benefits to small businesses and local governments. There would be more money for school and art non-profits, which enhance the quality of life in communities.

*Let’s talk about R.E.S.P.E.C.T.

The Roundtable’s statement gives a nod to local communities with the bland statement that calls for respect and “sustainable” practices.

But respect is ephemeral. And kind of meaningless when corporations balk at taking responsibility for paying for roads, schools, clinics and first-responder care in their local towns.

The reality is that some corporations have enjoyed juicy profit statements (and nice packages for the C-suite executives) with the assistance of corporate tax cuts and property tax breaks. These breaks mean that the tax burden is carried by the rest of the community. And on a federal level, it means higher deficits – and a crazy debt load to be paid back by the next generation via … yup, more taxes.

So when it comes to respect … why not make it meaningful and sustainable by simply paying a fair share?

Or just doing the right thing?

Change of the Corporation

For another view about the role of corporations, see Nicholas Lemann’s op-ed piece in the Wall Street Journal, and how the role of corporations changed in the post-Depression era. Large companies once offered workers lifetime security and generous benefits, and felt obligations beyond the shareholders’ mandate to make a profit.

“The corporation,” Mr. Lemann writes in his latest book, “when it could be successfully pushed into behaving like a social institution, was the American welfare state.” He chronicles how that role was then upended by the dominance of the financial sector… with results that readers may either celebrate or abhor (depending on how their portfolios survived the latest recession).

Or read Lemann’s social history of corporations, which came out this fall: Transaction Man: The Rise of the Deal and the Decline of the American Dream

See also:

- https://www.wsj.com/articles/business-roundtable-steps-back-from-milton-friedman-theory-11566205200

- https://www.economist.com/leaders/2019/08/22/what-companies-are-for?frsc=dg%7Ce

- https://en.wikipedia.org/wiki/Friedman_doctrine

- https://corpgov.law.harvard.edu/2018/10/14/the-ceo-pay-ratio-data-and-perspectives-from-the-2018-proxy-season/