Artificial intelligence is no longer an abstract idea touted in science fiction movies. Voice recognition and facial recognition have infiltrated our daily lives, taking over mundane tasks and adding security to things like cell phones and laptops. Studies show that more than two-thirds of mobile users already use AI in some form, whether they know it or not. Have you used your phone to find the fastest route to a meeting? Or asked an assistant like Siri to find info for you? That’s AI.

In many cases, this is welcomed technology and advancement. And the opportunities for business artificial intelligence are extraordinary, including in the financial world. So how will AI affect your investments, assets, retirement and overall financial future?

Facing the Fourth Industrial Revolution

Artificial intelligence has become so prominent and universal that it is often referred to as the Fourth Industrial Revolution. Artificial intelligence, or AI, is broad and can refer to many different technologies, however it is often described as IT systems that sense, understand, learn and act.

One of business artificial intelligence’s greatest powers is the ability to more accurately make predictions – a power that is constantly improving.

As automation improves, the question is begged: what does that mean for us humans?

While outlooks on AI are generally positive, there are some healthy concerns, including the human affect. And for good reason.

The University of Oxford’s Future of Humanity Institute surveyed leading machine learning researchers about AI’s progress. The consensus is that “AI will outperform humans in many domains in the next 40 years, such as translating languages (by 2024), driving a truck (by 2027), working in retail (by 2031), writing a bestselling book (by 2049), and working as a surgeon (by 2053).” Researchers also believe that AI can outperform humans in ALL tasks in 45 years, leading to automating all human jobs in 120 years.

These are bold predictions that make many people anxious. The fact is, automation is coming quickly. So how do you best prepare for and implement it?

Where Business Artificial Intelligence Makes Sense

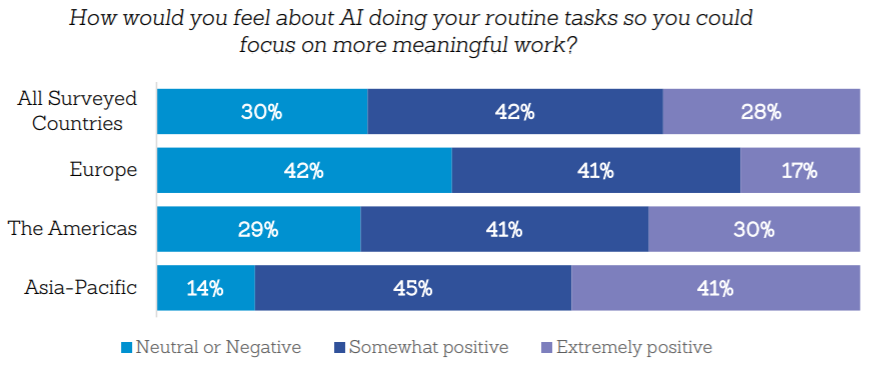

In a survey conducted by Dale Carnegie, about two-thirds of people are worried about losing their jobs to AI advancements. Yet 70% are happy to hand over some of the more mundane activities to AI, allowing them to focus on more important tasks.

*From Dale Carnegie’s “Beyond Technology: Preparing for Success in the Era of AI”

In short, coordinating work is easy to automate with business artificial intelligence; thinking creatively, using judgement and applying social intelligence is not. Humans have the advantage when it comes to problem solving and strategizing, essential tasks of a financial advisor.

While it’s clear that technology advancements have many benefits, there are also downsides and times when human interaction should take precedence. For example, consider robo advisors. These automatic investing platforms leverage strategies based on AI algorithms to build a portfolio. They are a hands-off, low-cost approach to investing. That is, when the market is doing well. But they can actually cost you more in the long run.

Robo advisors automatically rebalance your portfolio, making the performance potentially lackluster. You could be leaving potential profits on the table, and frequent auto-rebalancing could tally up transaction fees. And without the personal, human touch, robo advisors don’t take into account your whole picture of investments, assets and financial goals; instead, they are hyper focused on one area.

Robo advisors automatically rebalance your portfolio, making the performance potentially lackluster. You could be leaving potential profits on the table, and frequent auto-rebalancing could tally up transaction fees. And without the personal, human touch, robo advisors don’t take into account your whole picture of investments, assets and financial goals; instead, they are hyper focused on one area.

Another example: in person meetings and the simple act of shaking hands promotes cooperative strategies and positive negotiations. Robo advisors or even virtual meetings cannot make that connection.

The way to reap the most benefit from artificial intelligence is by blending human and machine work. Using AI for data collection and analyzing can save time and in turn, costs. Then having a human interpret the AI-derived data uses experience and social intelligence to make informed, fair decisions that reflect all available information.

A human can also explain his or her decisions, making the process more transparent. By its nature, AI is not transparent. Machine learning algorithms make it difficult for engineers to determine what prompts AI decision making.

Building a Beneficial Human-Machine Relationship

To fully benefit from a human-machine relationship, one must embrace AI and its capabilities. Failure to do so makes companies less relevant and competitive. Three things make AI an easier prospect to run with:

- Trust the leadership or company that is implementing AI. As noted, AI decision making isn’t always transparent or easy to understand. We don’t like or trust what we don’t understand. So it’s important to trust the entity that is choosing to use AI. For the entity, be it a CEO or financial investment firm, that means being honest and consistent. And protecting clients’ privacy above all else.

- Understand more about what business artificial intelligence does. This doesn’t mean understand every technical detail, but the process should be explainable. This responsibility falls to the leadership or company. If a financial advisor explains how an AI algorithm narrows down predictions for specific stock performances that align with your portfolio investment strategy, you are more likely to trust in that investment firm and AI.

- Have confidence to be able to adapt. Confidence helps you to look at change as an opportunity rather than an obstacle. Implementing AI is an opportunity and is most successful when an organization is agile. This means using the right tools and process that take advantage of modern technology while combining resilience, social intelligence and the ability (and willingness) to take action.

As fiduciary financial advisors, we’re already agile and trustworthy. We watch the markets, use data and experiences to make predictions, and we redirect the course if and when needed.

What a human financial advisor has over robo advisors is the ability to know you, the investor. Your financial goals are more than just a number. Your assets are more than just a list. While business artificial intelligence can be harnessed to help us make the best decisions possible, AI is not the single solution for anything – especially the wealth you have worked so hard for.

At Stableford Capital, we certainly welcome technology that makes our jobs more accurate and helps your wealth grow. We are cautiously excited about the possibilities that business artificial intelligence brings to the table, while continuing to be diligent and confident in our own abilities as financial advisors. Unlike AI, we cultivate personal relationships with our clients that only lead to more informed wealth management and strategic tax strategies. That is what our integrated advisory approach is all about.

To learn more about how we utilize artificial intelligence in your financial road map, contact us online or call 480.493.2300.