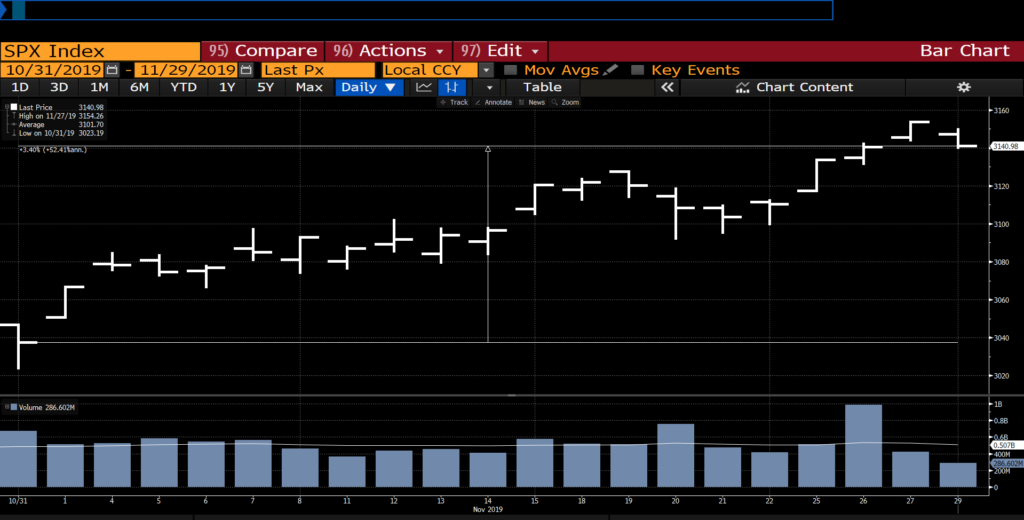

S&P 500 increases in November

The S&P 500 increased 3.4% during November on the hope that a trade deal with China would be signed and belief that the economy had bottomed (Figure 1).

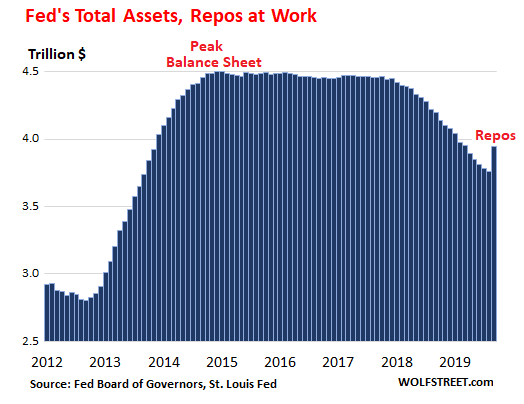

Investors were getting nearly euphoric, and measures of value were beginning to look stretched (though a slight correction at the beginning of December rectified some of this). Recent US economic data has certainly showed signs of recovery. However, the data needs to show continuous progress with equity valuations at current levels as much of the good news has been anticipated. Other factors propelling the market include the Fed, which after a year of shrinking the balance sheet, began making stealth QE injections of liquidity into the repo market. This appears to have goosed risky assets (see graphic below) during October and November.

US Treasury moved up in November

Yields on the 10 Yr, US Treasury moved up from 1.69% to 1.78% during November, though there was an intra-month high of 1.94%. Early December yields have bounced wildly as uncertainty abounds outside of the US. Trade, rumors of dissatisfaction with negative interest rate policy in Europe and rebounding global economic data are all factors and bear watching in 2020.

On the subject of 2020, please feel free to contact us should if there are any changes to your financial situation or if there are any adjustments you’d like to make (if we have not already spoken). Of course, we always enjoy your calls, answering questions or if you just want to chat—we always enjoy catching up.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a free trial of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.