S&P 500 Increases in December

Happy New Year!

The S&P 500 increased 6.4% during December (Figure 1), driven by the US – China preliminary trade deal and continued Fed stealth Quantitative Easing. While some of the details still need to be worked out with China, there seems to be a détente for now. This break allows markets to view the world order through rose colored glasses.

And why not? Post the Great Financial Crisis the once-independent Fed (and other central banks) have been socialized (nobody can ever feel any pain). Every time something bad appears on the horizon, the banks lower rates / buy assets. This is the consistent theme since 2008. And 2019 may be the best example given the strong rebound in equities once it became clear that the Fed was reversing course on its rate-raising scheme of late 2018.

Socialization of the Fed will not end well (eventually investors will lose faith in the dollar and US Treasuries). But for now, “don’t fight the Fed” are words to live by. December showed us this yet again as the Fed’s concern over the repo market (short term bank funding) drove it to provide nearly $500B in Quantitative Easing. This may be like using nuclear warheads in lieu of fly swatters, but it certainly is effective. We’ll be anxiously awaiting any updates on how the Fed plans to address the repo market issues in 2020. Any reversal of asset purchases will suck liquidity out of the equity market like a Hoover on cleaning day.

US Treasury Moved Up in December

In the meantime, yields on the 10 Yr. US Treasury increased from 1.69% to 1.92% (Figure 2). Perhaps the bond market is starting to expect better growth and higher inflation in 2020 as well.

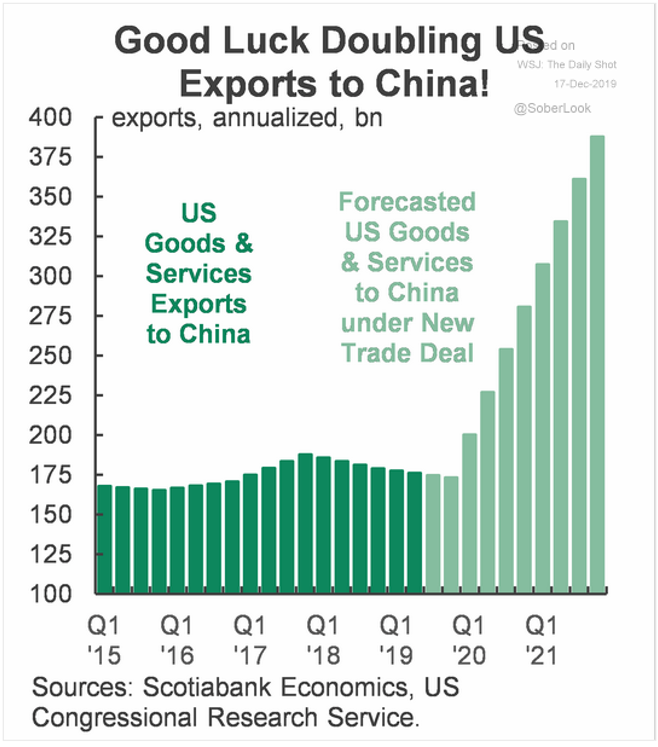

US Exports to China to Increase

As for the China trade deal, it seems a bit unrealistic as it assumes more than 2x the level of exports to China than ever before (Figure 3). At least the two sides are working together though. And given the President’s desire for re-election we wouldn’t expect much complaining for the next year or so (watch out after that!).

Speaking of elections, we expect markets will begin to focus on the US election at some point. It may be a nice run up to then. But, depending on who the Democratic candidate is—and the general election polls—markets may take a dimmer view of future prospects.

On the subject of 2020, please feel free to contact us if there are any changes to your financial situation or adjustments you’d like to make (if we have not already spoken). Of course, we always enjoy your calls, answering your questions or if you just want to chat—we always enjoy catching up.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a free trial of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.