S&P 500 Declines in January

The S&P 500 declined 1.9% during January (Figure 1), though it hit an all-time high on January 22 and has bounced to similar levels as of February 5. The run-up to all-time highs is largely explained by the Fed’s stealth Quantitative Easing (QE) program, as well as anticipation of better economic conditions following the détente in the US-Sino trade war. While the Fed denies QE is affecting markets, it’s hard to deny that since September when they began injecting $400BB of liquidity the equity market went straight up.

US Treasury Drop in January

The liquidity injection euphoria was disrupted by the emergence of the Wuhan virus around the 23 of January. Equity markets dropped 3% rapidly and Treasury’s spiked as investors sought safe havens, sending 10 Yr US Treasury yields to 1.51% on January 31 vs 1.91% at the start of the year. But as the virus looked to be contained (Figure 2), the market has rebounded back to the highs and bond yields have begun to move back up again.

As far as Stableford is concerned, we have weathered the volatility well thus far. With valuations high we have sought to buy out of favor equities with lower valuations in areas such as pipelines, energy and aerospace. In fixed income we lengthened duration (bought longer term bonds which move up more in price as yields fall) prior to the Wuhan Virus scare. Subsequently we’ve begun to reverse course as the contagion fear has subsided. However, the situation remains fluid and we are tracking it closely to determine next steps.

Wuhan Virus (Coronavirus) Notes

And finally, have you ever wondered what drives investors to drive stocks up in the face of seemingly bad news?

For example, with the spread of the Wuhan or Coronavirus and the threat of a slowdown it would seem it is time to pull back rather than buy.

The reason is that equity markets are forward looking (usually pricing in ~ 12 months of forward earnings). So, when the first signs of containment of the virus occurs, investors are willing to step in. Knowing this (and having lived through a few viral scares), we have been running internal models to track the rate of growth of the virus (as opposed to the overall number of cases). As the rate of growth of the virus slows, investors immediately begin to “price in” the financial impact. Once this is quantified, investors become more willing to once again make forward bets on earnings.

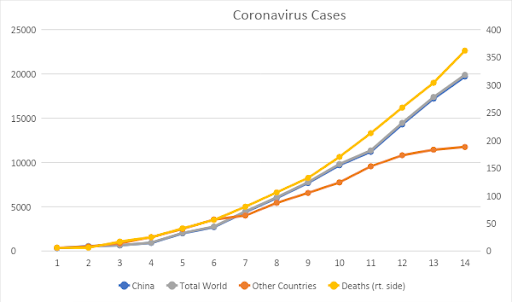

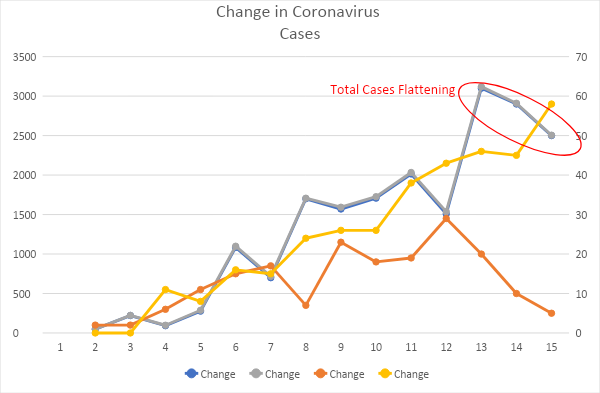

The graphs below in Figures 3 and 4 show this: On day 14 of a tracker (Feb 2) the number of new cases fell to 2900 from 3100 the previous day. The S&P 500 Index began its climb on Feb 3 when markets began to see the trend, which was later confirmed by another day of fewer new cases. Of course, all of this is subject to change and recent data seems to indicate that the slowdown may have been temporary. We will continue to monitor this and adjust accordingly.

Please feel free to contact us if there are any changes to your financial situation or adjustments you’d like to make (if we have not already spoken). Of course, we always enjoy your calls, answering your questions or if you just want to chat—we always enjoy catching up.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a free trial of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.