Stableford Capital— June and Mid-Year Review

Phew! Has there ever been a first half of the year like that? Historic declines in the equity and fixed income markets, pandemics, civil unrest, polarized politics, international discord, and the list goes on. It would be nice to have a break for a bit, but it doesn’t look like we’re going to get one. Rolling Covid-19 resurgence and the US presidential election should ensure a volatile second half as well (and those are the things we know about).

The S&P 500 was down 4% year to date through June. But that’s not half of the story. After jumping to +5% in February, the S&P 500 hit a low of -31% mid-March when the Fed and US government came to the rescue with trillions of dollars to backstop markets and make up for (and in some cases overcompensate for) lost wages (Figure 1).

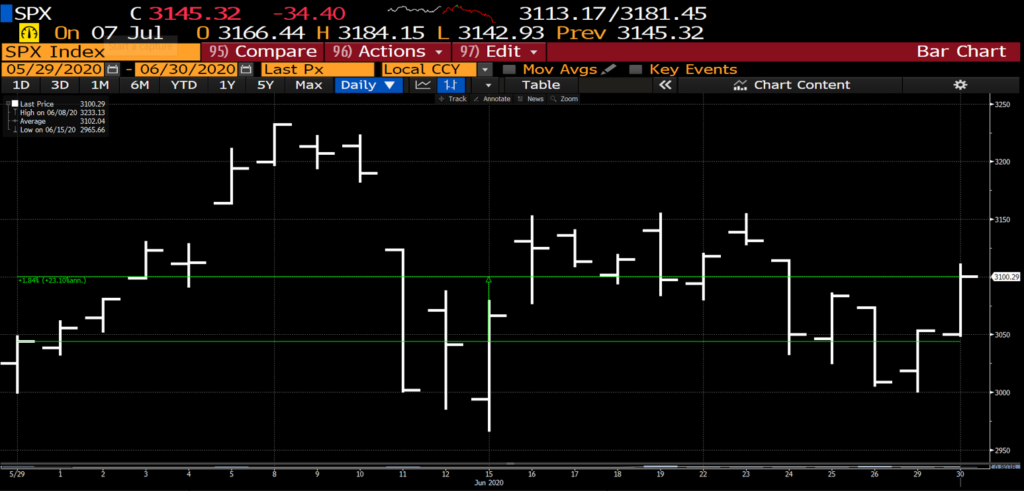

Subsequently, the index jumped 38% off its lows. June S&P returns were a rather tame 1.8%, though with a great deal of volatility as seen in Figure 2.

The government intervention has also led to a tight range on interest rates on US Treasuries since March. As of June 30 rates on the US 10 Yr. were 0.66%, nearly unchanged for the month and similar to where they began the second quarter. This is the result of the Fed, whose rhetoric and unlimited buying power have kept rates low after they fell from 1.9% at the beginning of the year (Figure 3). Of course, low rates help the economy a great deal. But they also lead to inflated asset prices. For now the Fed has bigger fires to put out, but this problem will come back to haunt them (and us) later through moral hazard and falling valuations.

In the meantime, the current market volatility stems from future uncertainty. With high expectations of future earnings (well above 2019 levels despite the drag from Covid-19) and high multiples, there is a lot riding on a continued rebound in economic activity. And while the rebound in employment and purchasing has been sharp, rapid jumps in Coranvirus infections in the Sun-Belt has given investors pause.

Stableford’s Positioning

At Stableford Capital, we are taking the volatility to heart. Having been through a few crises ourselves, we know that this one is not completely over. Certainly, we are on a better path with liquidity and better-functioning markets, particularly in fixed income. But Fed-driven liquidity can lead to high expectations and over-valuation. And while we like to participate, our bottoms up, fundamentals-driven  research and portfolio construction discipline keeps us from becoming too giddy.

research and portfolio construction discipline keeps us from becoming too giddy.

And that is where we are now. The Fed is on the cusp of creating a bubble in large-cap tech. Since the S&P 500 is market-cap-weighted, these stocks have an ever-larger impact on the index, driving it back toward the previous highs. Can this keep going? Yes. Is it prudent to get too involved? No. And that is how we approach the current market: Invested, but with an eye toward caution. As we have mentioned previously, we like upside, but capital preservation is important too.

We are finding some good values in small-cap and under-invested industries. It may take a while for these to rebound but they offer the most upside and the cheapest valuations. So, we’ll keep doing our research to find more of these names rather than chasing the FANG names higher. We like the risk-return a lot better.

Be well!

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a free trial of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.