Stableford Capital—March 2021 Review: The Interplay Between Inflation and Equities

The 10 Yr. U.S. Treasury yield continued its upward trajectory during March, rising from 1.41% to 1.74% (Figure 1).

Rates Rise in March

Given the interplay between rates and equities, this month’s Review will continue February’s rates discussion with a focus on inflation—an area of concern for many investors.

First off, this is not your father’s Oldsmobile. If you can remember the Oldsmobile tagline, then you can probably remember when inflation last dominated the headlines. Though it seems both have been discontinued (Olds was in 2004), inflation does still exist—we just haven’t seen it in its most pernicious form for 30 years.

So, what is different now vs. the last bouts with inflation? First, it is important to note that the US had tight labor markets in the late 1960s, and not many goods were produced abroad, as they are now. When unemployment fell to the mid 3% range spurring higher labor costs in the 1960s there was no alternative production site. Now, when prices go up manufacturers move production, such as the recent move of apparel and shoe production to Vietnam from China.

Recall too that that in the 1970s and 1980s the US more reliant on OPEC for oil. Now, we produce much of what we need at home. In 2019, the US produced 19.3MM b/d of oil and consumed about 20.5MMb/d. Though these amounts are roughly equal, we still imported around 9.1MMb/d because some US production is exported. However, even with the exports, the US is producing over half the level of consumption.

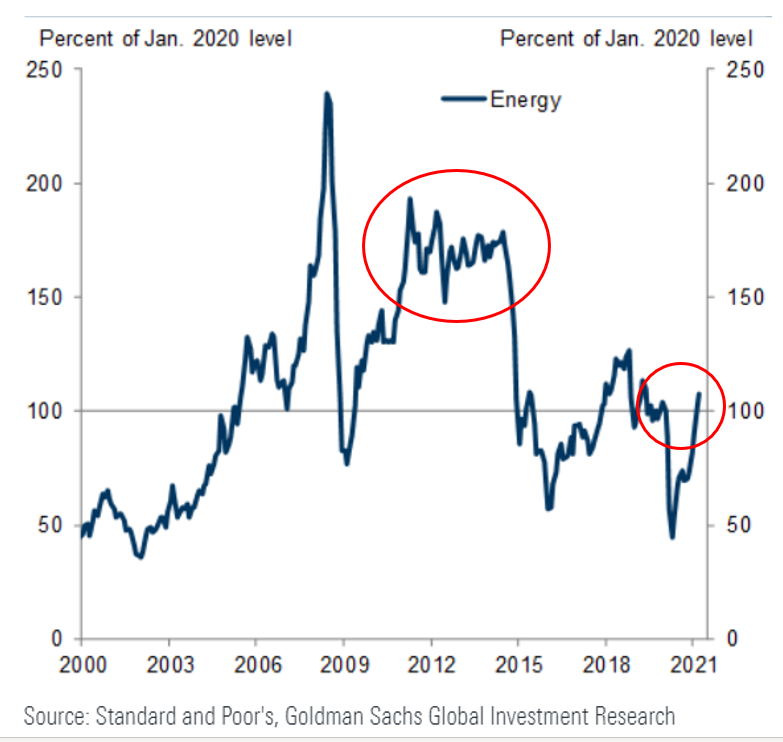

In addition, oil prices have not even reached levels we saw as recently as 2011-2015 yet (Figure 2). And with US shale drilling capabilities, it doesn’t take long for more drilling to occur should oil prices remain high. So, we are unlikely to have oil-driven inflation for a prolonged period as we did in the 1970s and 1980s.

Oil has rebounded – still far below even the levels of 2011-2014

Back when inflation was a problem, consumers expected it to be high and acted accordingly. Today, while inflation expectations are rising, they remain low, even relative to recent history (Figure 3).

Inflation expectations are low

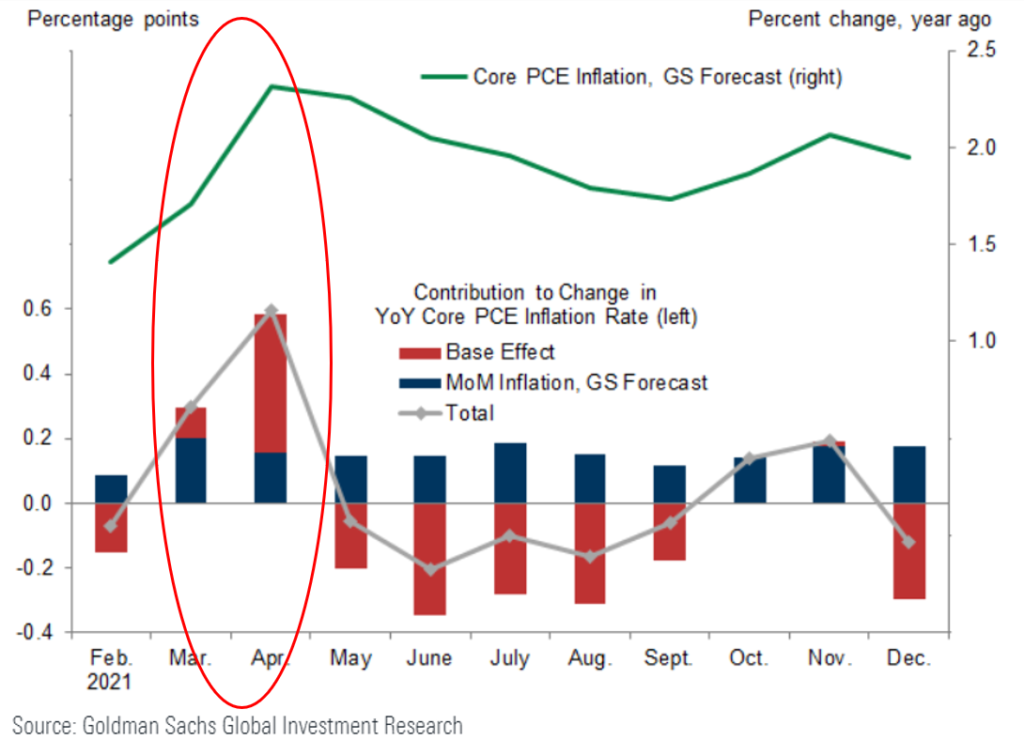

This does not mean we won’t have inflation. On the contrary, over the next few months, we are likely to see a spike over 2% Y/Y as seen in Figure 4. However, much of this is due to “base effects”, or the effects of having low prior-year prices during March and April. However, once we move into May and June, much of the base effect impact should reverse (as prices normalized after May of 2020).

Inflation is likely to spike…but only temporarily

Equities Bounce Off The Lows

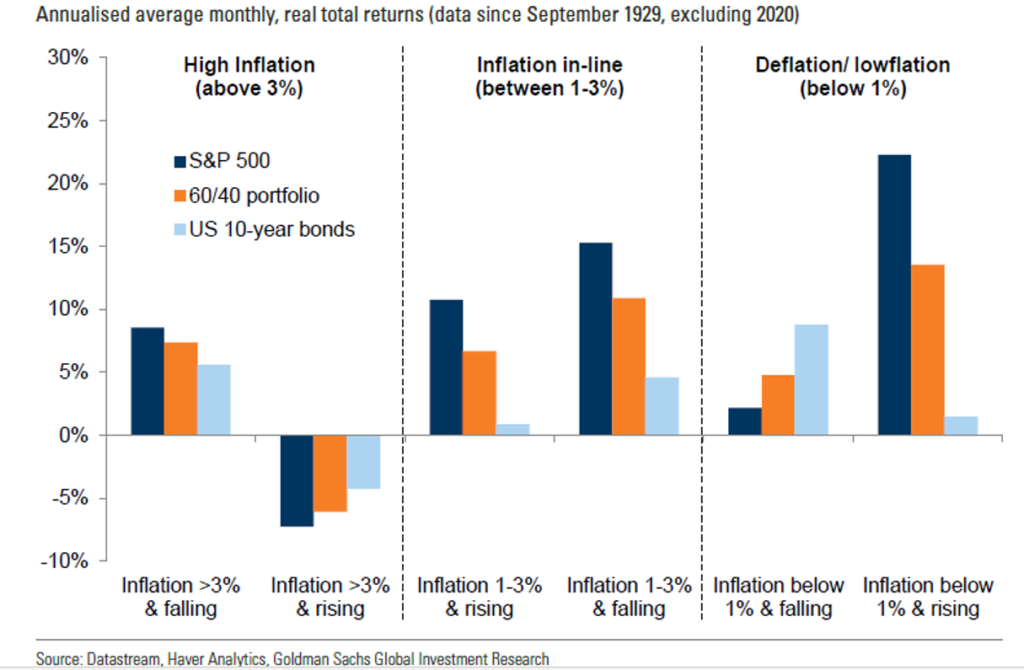

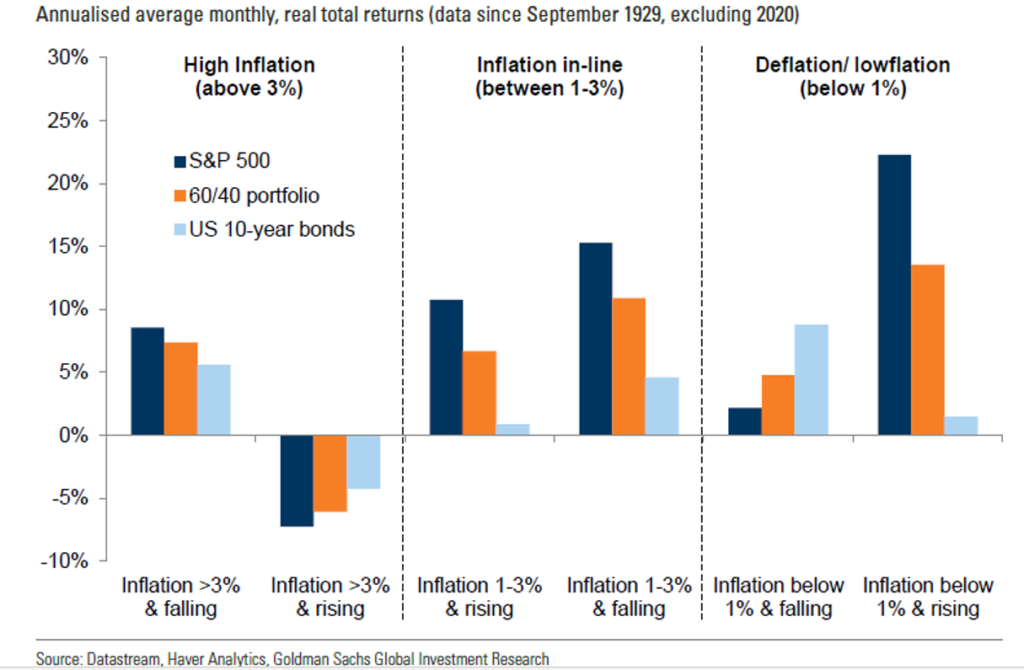

What does inflation mean to equities? Generally, inflation is OK as long as it isn’t above 3% and rising or accelerating too fast, or decelerating towards disinflation (below 1%) as Figure 5 shows.

Inflation is OK…Within Reasonable Parameters

The S&P 500 was up 4.2% in March, bouncing off the interest-rate-driven lows earlier in the month. For the most part, equities seem to be absorbing Covid-resurgence and interest rate driven fears. In addition, while performance was driven by cyclicals earlier in the year, growth stocks and tech have begun a mini-resurgence of late.

Equities have managed to shrug off the Biden administration’s higher corporate tax proposal as well. However, as we get closer to fall, the specter of higher taxation may begin to cast a shadow over the market if the odds favor Congressional approval.

Equities Bounce Off the Lows

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.