Stableford Capital – April 2021 Review: Equities Led by Resurgence in Large Cap Growth

The S&P 500 was up 5.2% in April, led by a resurgence in large-cap growth stocks and financials on the strength of earnings. Industrials and energy lagged during April as funds flowed into large-cap growth again. It is worth noting that this trend has begun to reverse in early May with cyclical outperforming growth.

Equities Led by Resurgence in Large Cap Growth

Approaching Peak Growth

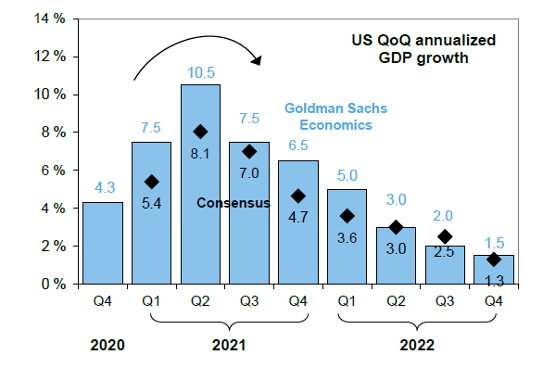

The consensus among economists is that US GDP growth will peak in 2Q 2021. Although growth will remain above trend, the tailwinds from fiscal stimulus and reopening should peak in the second quarter.

Peaking Economic Growth

Investment Research Market Commentary April 2021 – Peaking Economic Growth

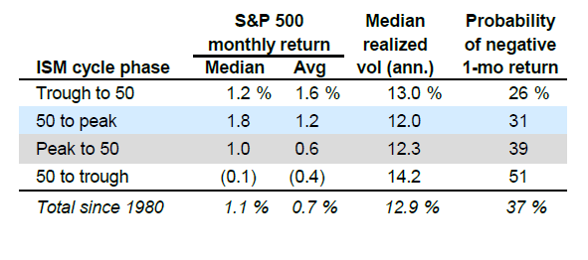

Why does this matter? Typically, equities continue to rise when economic growth slows—as long as growth remains positive (note that ISM, Institute for Supply Management, readings above 50 indicate economic growth). However, equity returns are typically not as good when growth decelerates as Exhibit 3 indicates.

Slower equity appreciation with decelerating economic growth

Market Commentary April 2021 – Exhibit 3

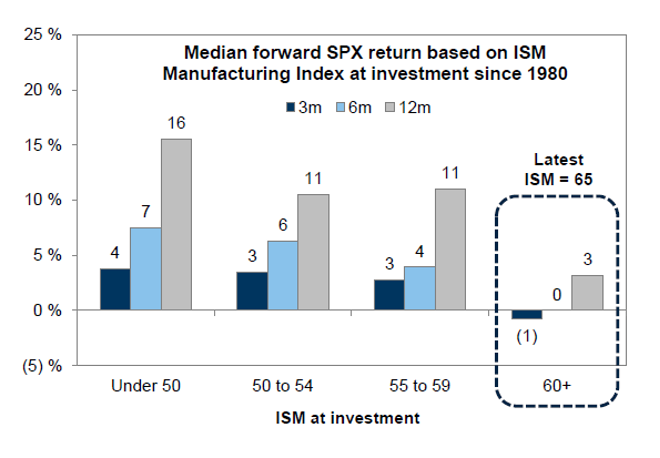

In addition, during the transition period to slower growth, equities often struggle. In the rare cases when the ISM is above 60, equity performance is weak on a 3-month and 6-month basis. The latest ISM reading for April was 61, down from 65 in March as seen in Exhibit 4.

Equity returns are weakest when economic growth begins to decelerate

Market Commentary April 2021 – Exhibit 4

Rates Fall in April

The 10 Yr. U.S. Treasury yield pulled back 11 basis points in April, falling to 1.63% from 1.74% (Exhibit 5). Rates moved up very quickly in March and most of the pullback seems to be a reset from the “too much, too fast” move of the prior month. We would expect long-term rates to continue their climb during 2021 based on inflation and economic growth expectations.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.