Stableford Capital – June 2021 Review: A Narrowing Market

The S&P 500 was up 2.25% in June, ending the month on an unconvincing run as breadth diminished even as the overall index increased. This narrowing participation strikes us as a sign of risk, as investors remain unconvinced about future strength and where rates will go. As a result, equities remain in equity-rotation limbo.

Equities Up In June

Fixed Income

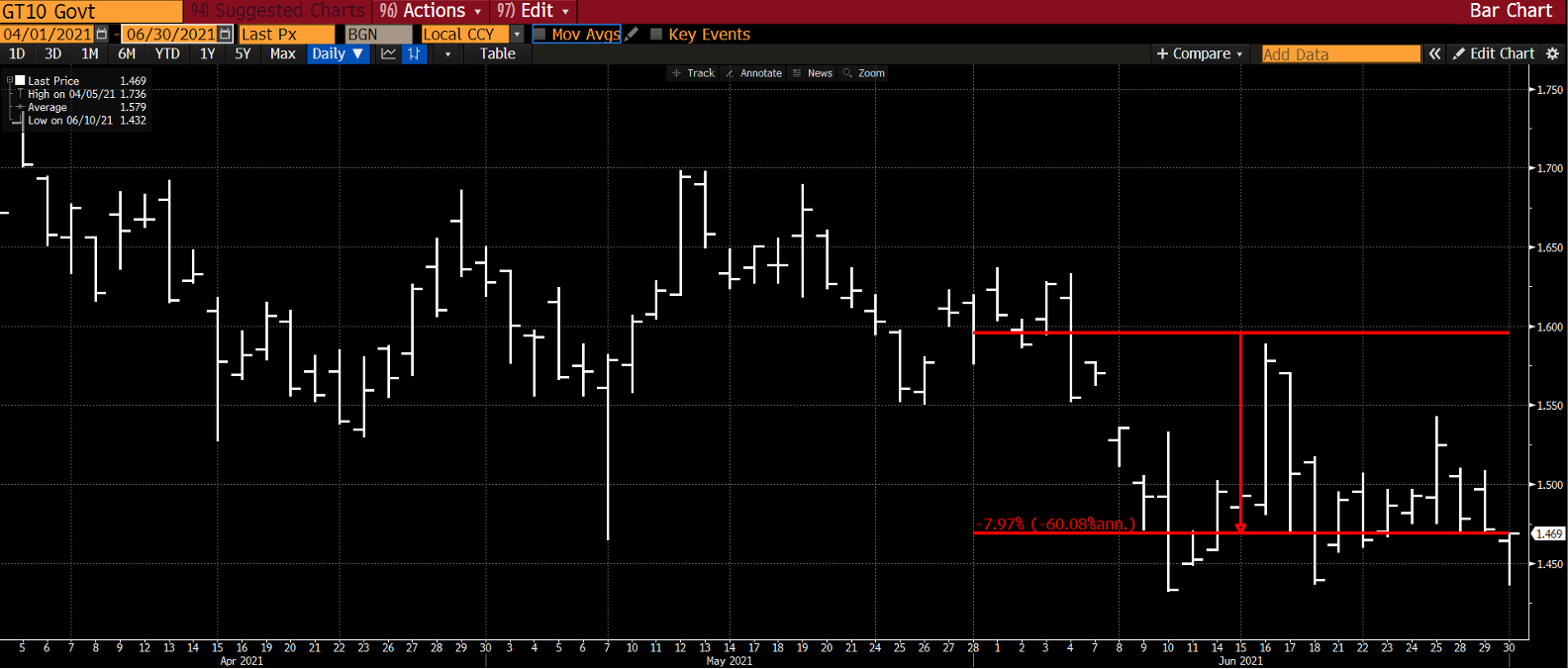

Rates Fell In June

The 10 Yr. U.S. Treasury yield dropped from 1.59% to 1.47% in June. The drop was driven by a decrease in inflation expectations, which drove 10 of the 12 basis point drop. But, as typically is the case, the mainstream press was rattling the inflation bell the loudest during this period. Many of the underlying drivers have peaked in year-year price increases (used cars and lumber for example).

Labor costs remain the wildcard, with many early retirements taken post-pandemic, plus those who prefer to be paid not to work by the government remaining on the sidelines. This is a difficult read, but we’d bet that the labor force has not gone through too big of a structural change beyond the early retirements. The real proof will come after the excess unemployment benefits run out in September. If it remains difficult to hire after that there will be more persistent inflation in the U.S.

Overall, the markets find themselves at a bit of an impasse now: Rates have begun to pull back as we pass (likely) peak inflation and economic growth begins to decelerate. The question now is where will growth settle out? Will it be 2% GDP or some lower number?

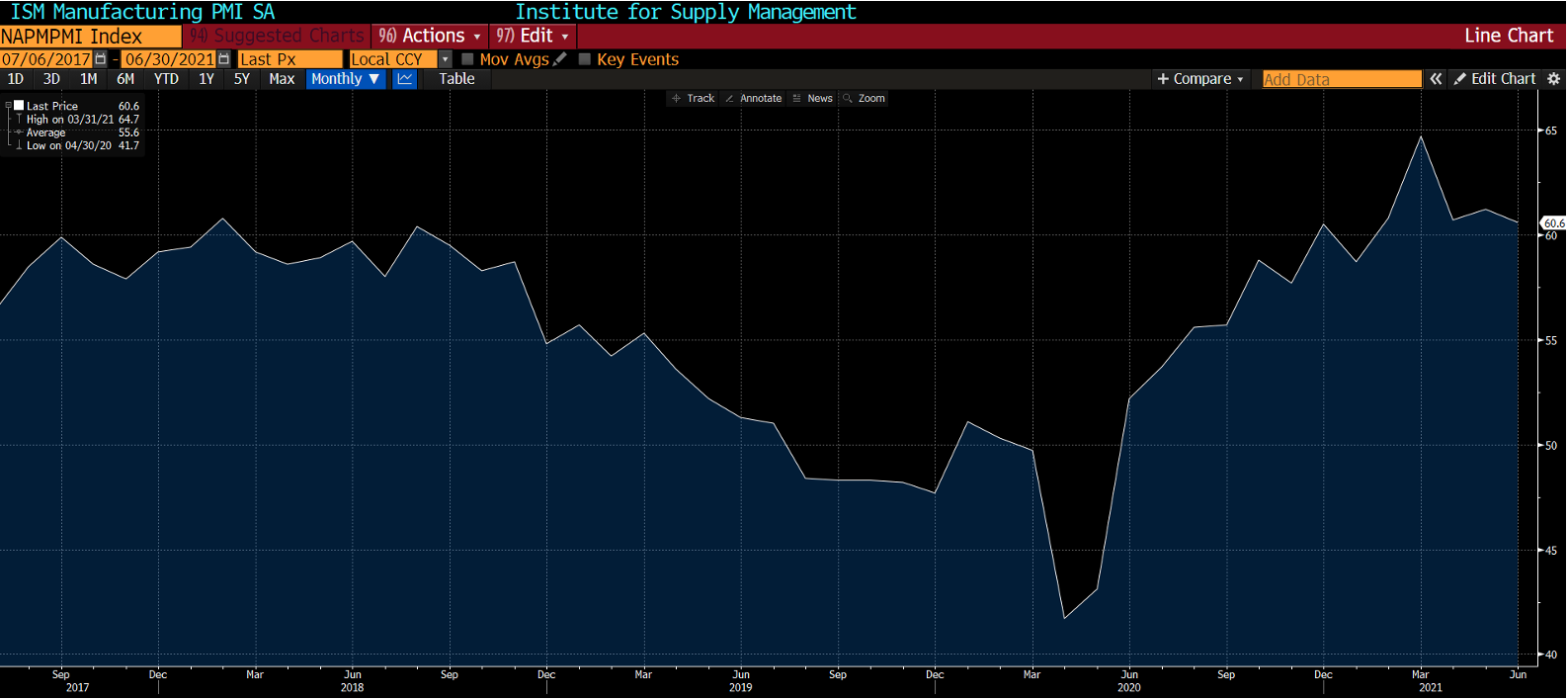

In the meantime, the cyclical names have started to underperform while high growth / high valuation stocks have outperformed. This makes sense for now. Our proxy for the peak in cyclical stocks, the ISM manufacturing index appears to have peaked (see Exhibit3).

ISM Manufacturing (a Proxy for Cyclical Growth) Has Peaked

The real key is if rates bounce again once it becomes clear that the economy is not decelerating too much. From our seat, we’d expect a pullback in rates during the uncertainty, followed by a move up as the economy maintains its strength. Additionally, if a large infrastructure bill is passed (i.e. greater than the approximately $1BB bipartisan bill), rates should begin to move up again.

On the other hand, the specter of higher taxes could begin to weigh on equities once Congress returns from recess. This is also a difficult read, as the intra-party gulf among Democrats on the left and right is substantial. As is typical with government issues, the results are binary. Higher taxes will cause an immediate swoon in equities, while the status quo will be seen as a positive.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.