When it comes to your investment portfolio, long term compounding of capital is key. This often means diversification of assets and a mix of active and passive strategies. However, for some generations, diversification also means digital dollars, but what is the future of cryptocurrency? Is it just a financial fad or a potential for stable, high returns?

Elon Musk of Tesla and Michael Saylor of MicroStrategy, corporate leaders show virtually no interest in parking corporate cash in Bitcoin. It also explains why almost no retailers will take payment in what its supporters bill as the currency of the future.

As for Bitcoin’s alleged status as a prized “store of value,” market participants change their minds on what it’s worth so fast that as an owner yourself, it’s hard to know whom to believe.

Even if you think Bitcoin will protect your purchasing power in the years ahead––and so far, it’s been tanking even as inflation jumps––you’d need nerves of steel to “hold” when the ride is this rocky.

The Bitcoin Backstory

Bitcoin is the most well-known cryptocurrency – a digital or virtual currency secured by cryptography – dating back to 2009 when it was created. The preliminary draw of using bitcoin was that it eliminated the need for banks, and their associated fees, making international transactions both simpler and cheaper.

It also allows for anonymous purchases, opening the door for illegal activity. And since it is not associated with any one country, bitcoin has not been historically subject to regulation, though that is changing in some countries like China.

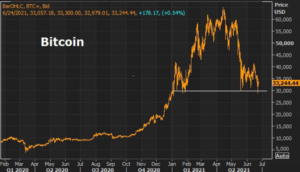

Some people bought bitcoin to use as currency, but many others intended to hold and trade it as an investment. By 2017, the price of bitcoin was in the thousands and has reached its peak in April 2021.

Bitcoin is just one form of cryptocurrency, but it is representative of the market.

So what does this mean for the future of cryptocurrency? As it turns out, that depends on your generation.

What Is the Future of Cryptocurrency? Ask the Millennials.

At one point, bitcoin was THE hot cryptocurrency commodity and had millennials clamoring trade. Older generations are more cautious about this new type of currency and digital investment, holding out to observe its staying power. Quick to point out the Dutch Tulip mania.

A Piplsay study confirmed that millennials tower as the top generation to own cryptocurrency.

- 49% own cryptocurrency (as compared to 38% of Gen X and 13% of Gen Z)

- 53% are “very likely” to adopt cryptocurrency as a form of payment (40% Gen X and 7% of Gen Z)

A CNBC Millionaire Survey found that almost half of millennial millionaires have 25% or more of their wealth in cryptocurrencies, and a third have a fairly even split of 50% in crypto and 50% in NFT tokens.

Millennials range in age from 25 to 40. For the older end of the generation, they have grown up with this technology and are likely more comfortable with it, especially since digital wallets are a part of popular videos games like Fortnite and Minecraft.

For the younger end, they may not have credit cards or bank accounts yet, so cryptocurrency is their introduction to transactions.

An interesting caveat uncovered by another study showed that Millennial cryptocurrency investors have 5.4x more student loan debt and 2.3x more auto loan debt than the national average.

Gen Z Primed to Take Over

The six to 24 age range of Gen Z inherently puts them at a disadvantage for being the cryptocurrency-dominate generation. However, those investors in their late teens and early 20s are quick to cite the affordability and simplicity of investing in cryptocurrency.

The six to 24 age range of Gen Z inherently puts them at a disadvantage for being the cryptocurrency-dominate generation. However, those investors in their late teens and early 20s are quick to cite the affordability and simplicity of investing in cryptocurrency.

For Gen Z, the interest in digital currency is actually rooted in the disinterest of traditional financial institutions and investments, along with an independent drive. Many like to do their own research rather than rely on information and assistance from financial advisors.

This generation is also big on feeling connected, be it to a job, nonprofit organization, or investment. Many believe in blockchain technology and see it as the direction of currency, intending to hold on to crypto investments for the long term. And for some, this means being willing to take more risks.

A Gen Z investor told CNBC’s Make It: “As I began to understand the blockchain and the technology behind it, that is when I felt comfortable saying ‘OK, even if I invested when bitcoin was priced at $60,000 and it drops down to, let’s say, $20,000 or even lower, I can still support it, even if I lose money in the endeavor. The risk was worth it because I liked the technology.”

To Gen Z, cryptocurrency is not a fad – it’s an accessible future.

Gen X Are the Big Spenders

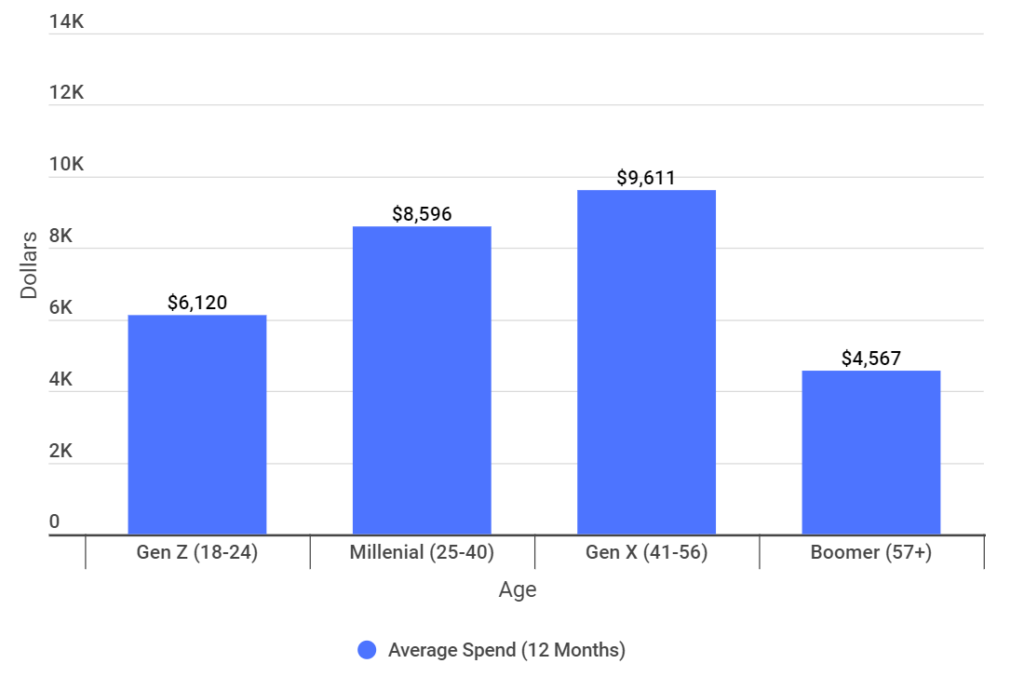

What do Gen X investors have over Millennials and Gen Z? Assets. While the two younger generations are out-investing Gen X in percentage of investors, making up 94% of all cryptocurrency buyers, Gen X is outspending them.

What do Gen X investors have over Millennials and Gen Z? Assets. While the two younger generations are out-investing Gen X in percentage of investors, making up 94% of all cryptocurrency buyers, Gen X is outspending them.

A study revealed that Gen X buyers averaged about $9,600 in crypto in 2020, up $1,000 over Millennials and $2,500 over Gen-Zers.

It comes done to access. Gen Xers have established their careers, accessed lines of credit, and accumulated disposable income. They have more access to funds and more spending power. They are also well educated.

Another interesting discovery from the aforementioned Piplsay survey: 88% of all cryptocurrency investing / trading is adopted by those with college or master’s degrees.

Boomers Cringe at Cryptocurrency

Millennial cryptocurrency buyers outnumber Boomer buyers by a staggering 62.9x, making Boomers account for less than 2% of all crypto investors.

Millennial cryptocurrency buyers outnumber Boomer buyers by a staggering 62.9x, making Boomers account for less than 2% of all crypto investors.

Data from multiple sources back up the fact that the older you are, the less likely you are to buy and invest in cryptocurrency. Boomers also spend the least in the crypto market – $1,500 less than Gen-Zers.

What may make this generation hesitant of the cryptocurrency boom is exactly the opposite of what attracts Gen Z – Boomers have an appreciation for history, suspicious of a digital coin without any intrinsic value, and are accustomed to traditional investment analysis. An investment without regulation or insurance is too risky, accept for the top one percent.

Case in point, just last month (June 2021), China shut down over 90% of its bitcoin mining capacity as part of a nationwide crackdown on that cryptocurrency in an effort to regulate speculative crypto trading to control financial risks.

Regulation attempts may help to ease Boomers’ hesitancy, but likely not enough to make them a powerhouse in this investment realm.

The Potential for a Cryptocurrency Crash

The U.S. is also considering regulation and acceptance of a form of cryptocurrency. In fact, the Senate Banking Committee just held a hearing on the potential for a central bank-backed digital currency. While mainly exploratory, the hearing also publicly bashed the private cryptocurrency market, (i.e. bitcoin).

As the market has gained traction and popularity, it has also opened new doors for corruption. After all, cryptocurrency was also at the center of the Colonial Pipeline hack, though the Justice Department was able to “recover” over $2 billion of the collected ransom.

Speculation is mounting and has posed cryptocurrency for a potential crash, as demonstrated in this chart from billionairesportfolio.com.

Digital Dollar Benefits

Despite the cybercrimes, speculation, and regulation hurdles, there are many benefits to adopting both nationwide and global digital currency, and it seems inevitable.

Since the Bretton Woods Agreement in 1944 when global currencies were tied to the U.S. dollar, U.S. currency has been the pillar of global finance and the preferred international reserve currency – even today when no formal declarations or agreements mandate it. This is because default global currency provides the much-needed global public goods and helps to stabilize the global financial system.

An adopted U.S. digital dollar could work to preserve the strengths of our existing currency, while also:

- Asserting American standards and values.

- Boosting economic growth.

- Offering more efficient transactions.

- Protecting funds.

- Driving policy efficacy.

- Promoting trust and assuring accountability.

This thereby benefits the global economy by enforcing global order and standards, stabilizing shocks, and making mature capital markets accessible.

Cryptocurrency in Your Investment Portfolio

Whether you fall into the 94% of crypto buyers aged 18-40 years old (Gen Z and Millennials), the more savvy Gen X spenders, or the wary Boomers – cryptocurrency is likely here to stay and worth learning more about to make educated decisions with your financial advisor about its place in your portfolio.

Whether you fall into the 94% of crypto buyers aged 18-40 years old (Gen Z and Millennials), the more savvy Gen X spenders, or the wary Boomers – cryptocurrency is likely here to stay and worth learning more about to make educated decisions with your financial advisor about its place in your portfolio.

Are you interested in breaking down the blockchain technology to see how it could directly affect or benefit your wealth? Contact Stableford Capital online for a complimentary 15-minute consultation, or call 480.493.2300.