Stableford Capital—September 2021 Review: Reality Begins to Set In

In a year beset with Meme Stocks, Robinhood, and multi-trillion-dollar budget proposals, reality looks to be coming back into view again this fall.

So, what gives? Why in a year of (mostly) suspended reality do markets suddenly seem to be worrying about risk? Two reasons: 1) The Fed is going to start to taper bond purchases/inflation fears are rising; 2) economic growth is beginning to decelerate as evidenced by declining 3Q21 earnings estimates.

Regarding the Fed taper, this is the clearest Chairman Powell has ever been (perhaps he knows the gig is up and President Biden is going to replace him with a true dove like Lael Brainard). Barring a material change the bond purchase taper will begin in November and end in mid-2022. Translation: The punchbowl is being taken away.

As we have pointed out previously, falling rates and an accommodative Fed make for inflated asset prices. But now rates are starting to increase. The 10 Yr. U.S. Treasury yield increased from 1.3% to 1.49% in September (Exhibit 1), both due to the taper message and fears of more persistent inflation.

Rates Increased in September as Fed Signals Taper Start in November

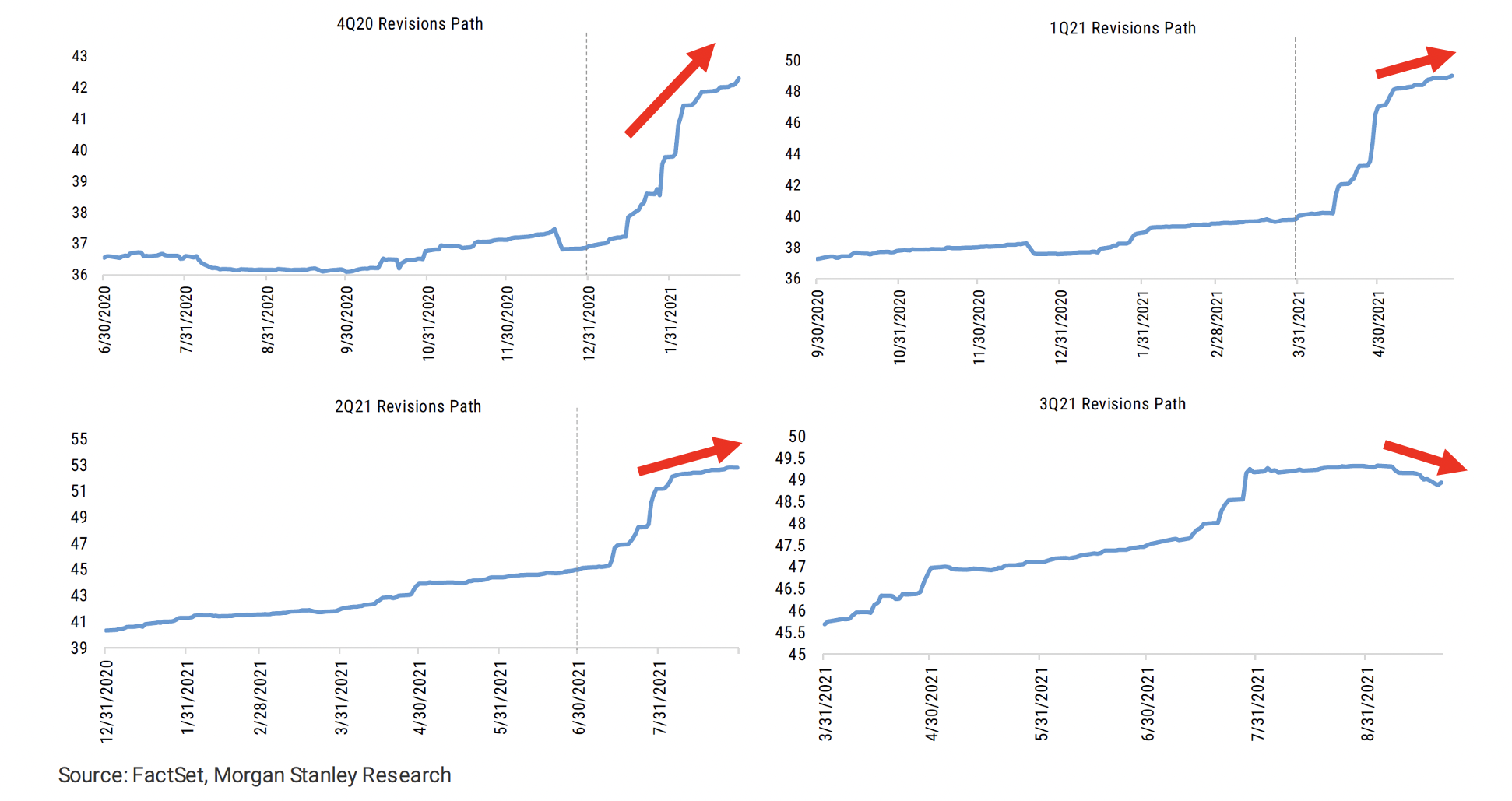

While rates are increasing, 3Q21 earnings estimates are starting to come down, a stark contrast to the prior three quarters when they were accelerating (Exhibit 2). Declining earnings spark investor concerns about the sustainability of the economic cycle.

Earnings Estimates Decline For 3Q21 Contrasts with Acceleration in Prior Three Quarters

And as investor concerns increase, equities begin to fall as evidenced by the 4.8% decrease in equities in September (Exhibit 3).

Equities Up in August

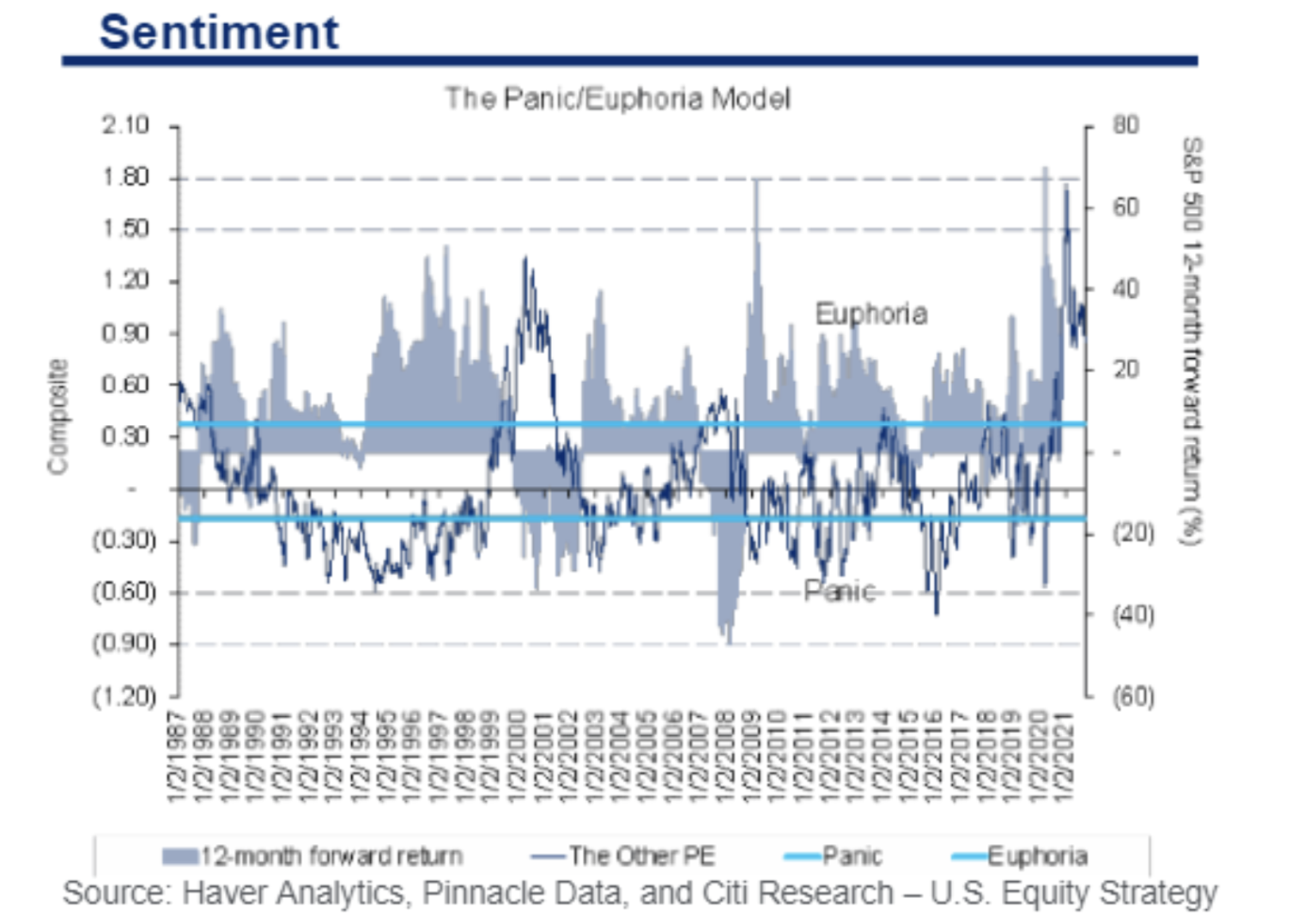

As far as Stableford’s positioning, we remain defensive. The potential for more sustained inflation along with high valuations and decelerating growth on the heels of an unprecedented fiscal and monetary stimulus is not a great recipe for high future returns. In fact, many long-run indicators like the Citi Panic/Euphoria Model (Exhibit4) indicate that the prospects for high future returns from here are unlikely (but negative returns are likely). That said, we remain alert to mispriced securities where the risk of permanent loss of capital is low, and the upside is high.

Citi Panic/Euphoria Model

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.