If you are an individual investor, who is seeking an independent financial planner or financial advisor you can work with either a registered investment advisor RIA or a Broker Dealer.

If you are an individual investor, who is seeking an independent financial planner or financial advisor you can work with either a registered investment advisor RIA or a Broker Dealer.

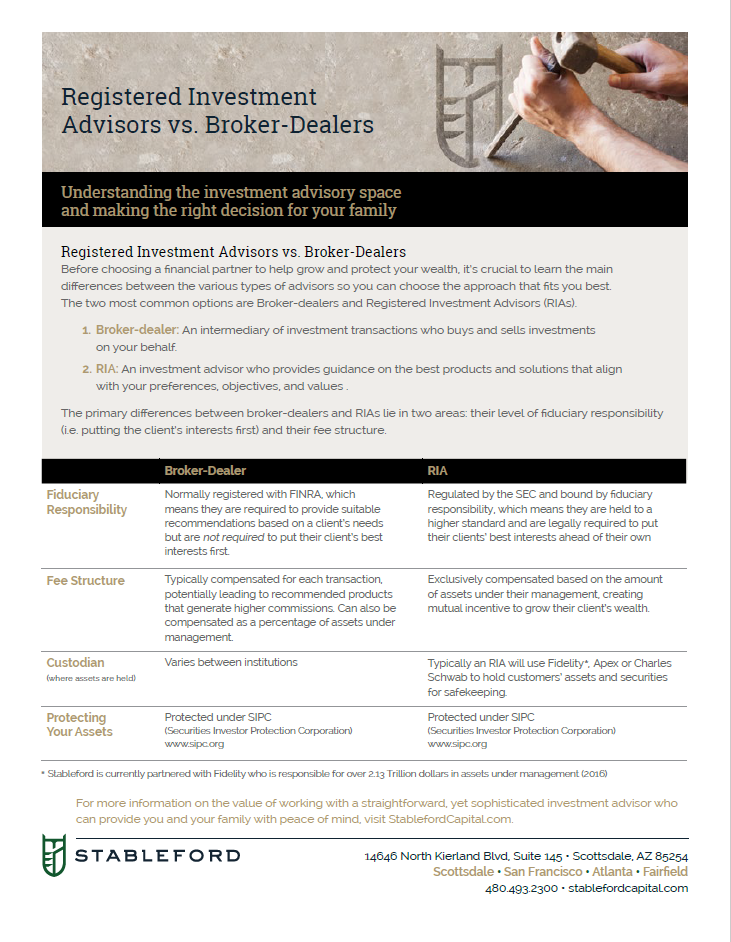

Typically, a registered investment advisor (RIA) works with high net worth clients to help manage their assets. Charges by a RIA are generally based on the percentage of assets that are under management. Others charge fixed rates, or charge hourly. A RIA can make trades on your behalf, and aid in transactions.

A broker dealer is someone who facilitates investment transactions. In many cases, a broker dealer receives their compensation through commissions and are based on investment transactions made on your behalf.

Regulation and Disclosure

The most important difference is how each group gets regulated. Registered Investment Advisors have a fiduciary duty to their clients that requires them to put their clients’ interests ahead of their own.

“Fiduciary” is a derivative of the Latin word “fiducia,” meaning “trust” — someone who is held to a higher standard of conduct in order to avoid conflicts of interest.

RIA’s are regulated directly by the Securities and Exchange Commission. This type of financial planner is held to a fiduciary oath and a higher standard of conduct as they must fully disclose a conflict of interest or eliminate it. Additionally, an advisor isn’t allowed to conduct trades directly for the advisor’s own institutional account with clients unless details about the transaction are released to the client and the client gives consent. A registered investment advisor is bound by law to adhere to your best interests.

Broker-Dealers that work with the public typically become members of the self-regulatory Financial Industry Regulatory Authority, or FINRA. Broker-dealers owe a duty of fair dealing with their clients and must not sell investments to their customers unless those investments are suitable for the customer’s needs. When making a recommendation of particular investments, broker-dealers must disclose material conflicts of interest. However, you have to be aware that a broker dealer isn’t required to meet fiduciary standards.

Which Approach is Right for You?

As an investor, you can get solid advice from either a a registered investment advisor or broker-dealer. It’s important to understand the different regulatory standards that govern each and which better suits your needs. Consider your investment goals and preferences and make a decision that better suits you.

Do you have additional questions about this topic? Feel free to contact us or call us directly at 480.493.2300