What is the difference between trading vs. investing or active vs. passive professional investment management? Active management to Stableford Capital means constant attention to the portfolio construction process (this is not to be confused with trading). It means that to have risk-adjusted returns you need to have a tactical allocation to your portfolio. The road to compounding money is still hidden in the volatility of the returns.

Studies suggest that a lower correlation environment is more favorable for active management. Lower correlations imply each stock is trading based on its underlying fundamentals, rather than overall market risk. Low correlation environments have tended to favor tactical managers because the over-all market begins to recognize the company-specific issues the active manager has been looking at all along.

Decisions about what companies do with cash on their balance sheets are important for the value of a company’s stock. Passive managers cannot evaluate a company’s opportunity to add value with better cash allocation, nor can they avoid destroying shareholder value.

Tactical Allocation

The tactical allocation of your portfolio reduces exposures to companies they believe are making bad decisions with cash and increase exposure to those making good decisions with their capital.

Additionally active managers are in the best position to take advantage of valuations by seeking out the stocks that are mispriced. The ‘hold and hope crowd’, as a general rule must follow the index and cannot add stocks to the portfolio based on whether they think the company is attractively valued.

Steering through the macro-economic landscape for several years, Stableford Capital experts see very little will change – slow global economic growth. Where we differ from most economic strategists is an expected rise in overall market volatility…the days of single digit VIX (volatility index) are behind us.

Oppenheimer had a relevant article on active management. Asking why the index should be challenged, the article points out:

- The index may not be focused on fundamentals

- The index may not be as diversified as you think

- Some indices don’t screen for profitability

Slow Growth Periods

No question strong Fed induced economic growth environments can hide many flaws within individual companies while slow economic growth underscores the importance of an individual company’s competitive advantages – and actually produce bottom-line revenue growth. During periods of slow growth, companies that continue to grow have tended to be those with competitive advantages and/or superior products that have allowed them to maintain pricing power or take market share from competitors.

Over longer time horizons and normal market cycles, passive equity investing has meant settling for risk of the over-all market. While investing in equities is designed for long-term investors who can tolerate short-term bouts of volatility and potential losses, investors have the potential to do better than their passive counterparts if they allocate a greater percentage of their equity holdings when valuations are near historical highs.

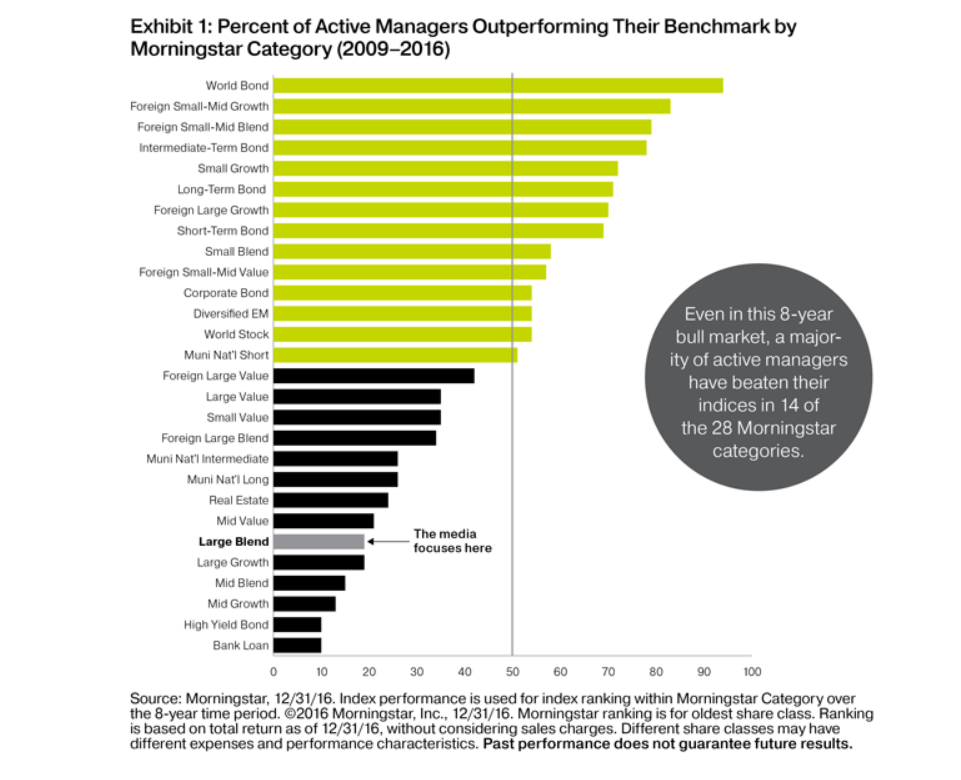

While passive funds can outperform most active managers when there is an atypical market environment, an active manager who can separate the good companies from the bad and who is willing to be truly different from the index is well positioned to outperform and provide potentially better returns for their clients.

Stableford Capital Active Professional Investment Management Is:

- Dynamic – Constant attention to the process

- Creates custom options – which are better for clients who have unique wealth considerations

- Institutional investment strategies applied to the individual investor

- Complex, nuanced and requires years of experience

- Manages the portfolio construction process in the context of the investment climate

- A partnership with you- we are always looking at the appropriateness for your situation