There are plenty of uncertainties when it comes to managing your investments, but you can achieve better financial health if you take action now. Building a solid portfolio with your financial advisor is a great start. To position yourself for growth and ensure you can maintain your desired lifestyle into retirement, you should also consider a financial to-do list.

While every person’s to-do list will differ slightly, we’ve outlined seven key steps and highlighted essential tax data and dates to help you get started.

7 Things You Can Do to Achieve Better Financial Health

- Get organized.

- Check your financial health.

- Clarify your goals.

- Assess investment performance.

- Improve tax efficiency.

- Review retirement and estate planning.

- Create a tax calendar.

Get Organized

It is crucial to centralize all your information so you have an inventory of your financial records. Ensure you have the necessary end-of-year bank statements, tax records, and investment documentation in an easily accessible file.

Create a system to keep track of your expenses and review them regularly. Identify patterns and look for better ways to reduce costs. Unnecessary spending detracts from your more significant objectives.

Check Your Financial Health

If you don’t already have one, develop a financial plan outlining your goals, timelines, asset allocation approach, and criteria for selecting investments.

Assess your current debt – equity vs. debt when it comes to investments is a balancing act. There is no reason you can’t do both, although paying off high-interest debt should be the priority since it will likely provide better returns.

It is also worth the time to create an investment policy statement (IPS) that outlines your financial goals, timelines, and criteria for selecting investments. If you already have an IPS, ensure it is aligned with your stated purpose.

Clarify Your Goals

Look at the year ahead and clarify what you want to achieve.

Whether you are in the accumulation, growing, managing, and preserving, or protecting and transferring your wealth stage, your circumstances will impact your long-term and short-term financial goals.

If you are still growing your portfolio, try to invest a minimum of 15% of your salary. However, if you’re a high-net-worth individual – aim higher.

If you are in retirement, review your spending rate and ensure it’s tenable for the years ahead. While it’s a good idea to discuss this with your financial advisor, you can start with an online calculator. One key thing to consider is disruption to your income – planning should include ensuring you have adequate coverage in liquid assets.

Assess Investment Performance

‘Breaking up’ with poor-performing investments is hard, especially when capital gains tax is involved. Still, it’s a necessary step towards better financial health.

Consider Tax Loss Harvesting as a strategy to help offset any negative impacts. You can reduce taxable capital gains and offset up to $3,000 of ordinary income by selling investments at a loss and replacing them with similar holdings. You also generate a tax loss to offset future gains in some scenarios.

Re-deploying your money into other investments that better align with your circumstances and financial goals doesn’t need to be a complicated experience. Your investment advisor can guide you through various strategies and ensure you build a customized solution.

Improve Tax Efficiency

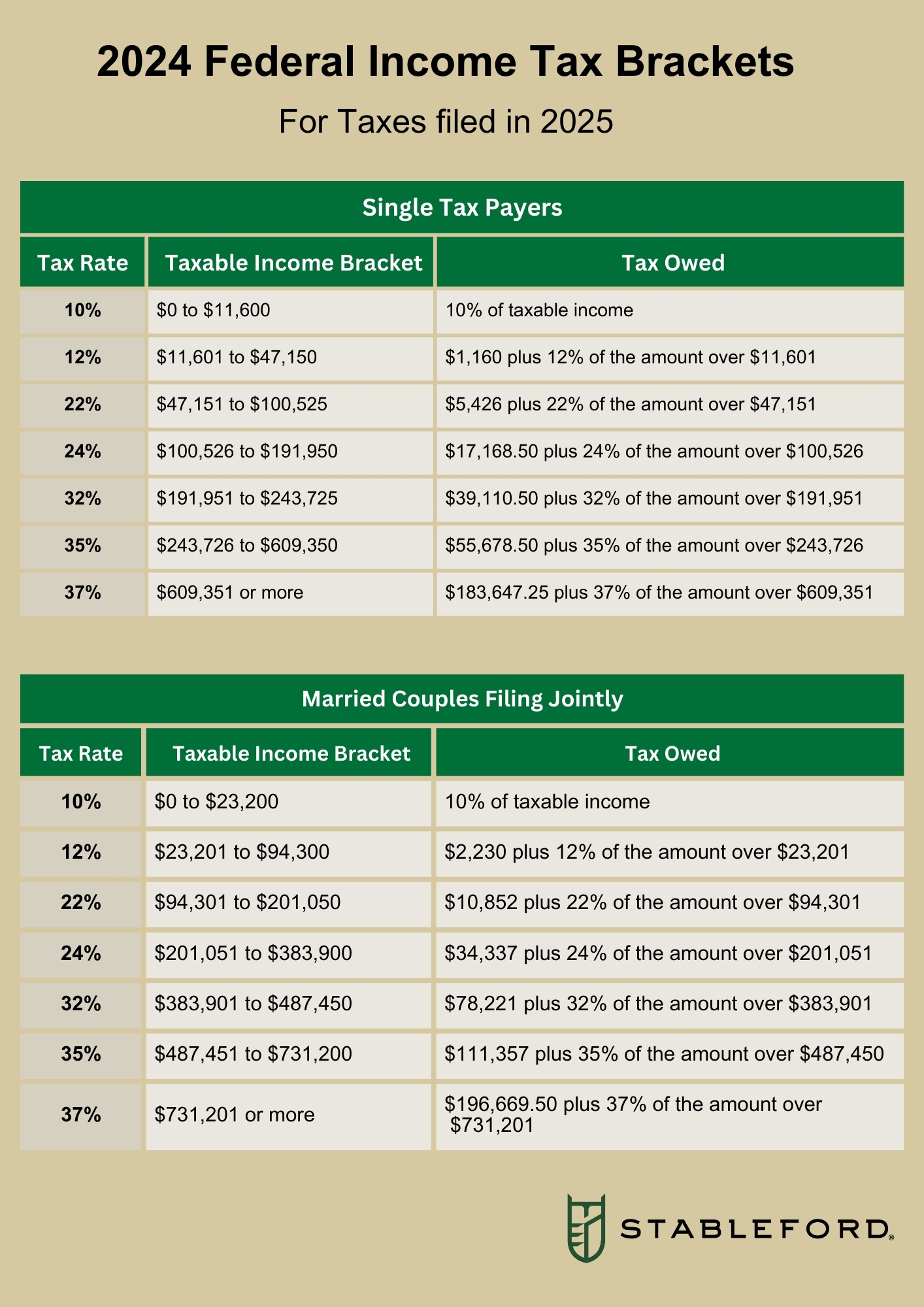

Understanding what changes affect your income limits will ensure you can take full advantage of tax-saving possibilities. The good news is

the IRS has raised thresholds for 2024 income tax brackets by roughly 5.4% per bracket. This means many households could see a smaller tax bill next year.

In 2024, standard deductions and some savings incentives have also increased. Standard deductions have expanded to $14,600 for single filers and $29,200 for married couples filing jointly.

Regarding tax brackets, if you are likely to exceed yours this year, consider bunching itemized deductions. That means concentrating deductions in a single year, then skipping one or even several years in the future.

Gift Tax exclusions have also increased from $17,000 to $18,000, which means gifting long-term appreciated securities may be more attractive than cash or check. Opening a donor-advised fund (DAF) can be an improved way of making these types of donations.

Another critical step in creating tax efficiency is conducting a tax audit. Stableford Tax can review your tax liability to discover gaps in your tax strategy. Having a coordinated approach between financial advisory, portfolio management, and tax is a powerful strategy that can provide you with the peace of mind you deserve.

Review Retirement and Estate Planning

The need for thoughtful financial planning doesn’t diminish when you retire; it simply shifts. The yearly tasks that should be on every retired individual’s financial checklist include:

- Review your spending and income plan since your expenses and income are likely to fluctuate yearly.

- Establish a tax-efficient withdrawal strategy for your income sources to maximize tax savings.

- Consider gifting to family members or contributing to a 529 college savings account for children/grandchildren to reduce your taxable estate.

- Update your estate plan. Check account titling, designate beneficiaries, update your will, and determine if you need a trust.

You should also be aware of the 2024 increases to accelerate retirement savings limits across IRAs, HSAs, and 529s, as outlined below:

- IRA: Contribution limits have increased from $6,500 to $7,000. If you are over 50, you can contribute an additional $1,000.

- HSA: Contribution limits have increased from $3,850 to $4,150 for individual coverage and families can contribute up to $8,300. These figures exceed the 2023 HSA contribution limits by approximately 7%. If you are over 55, an additional $1,000 for catch-up contributions is allowed.

- 529: Contribution limits have increased from $17,000 to $18,000 for an individual and from $34,000 to $36,000 per married couple filing jointly.

Create a Tax Calendar

Here is a quick reference to necessary tax due dates:

- Jan. 16:Final estimated tax payment for 2023 due.

- April 15: Individual tax returns are due for the 2023 tax year. First estimated tax payment for tax year 2024 due.

- June 17: Estimated tax payments are due for the second quarter of 2024.

- September 16: Estimated tax payments are due for the third quarter of 2024.

- October 15: If you applied for a six-month extension to your tax return, this is your new due date.

- December 31: Deadline for taking minimum distributions from traditional IRAs and 401(k)s. It is also the last date to contribute to company retirement plans 401(k), 403(b), and 457.

There is simply no replacement for experience to ensure you stay on top of your financial to-do list and to receive expert guidance while making decisions about your financial future.

Stableford Capital takes a holistic approach to financial advising by providing three integrated services – financial counseling, tax planning, and asset management – all under one roof. This enables Stableford advisors to provide comprehensive, tailored solutions that will help you protect and grow your wealth.

Take meaningful strides towards improved financial health this year by calling 480.493.2300 or contacting us online to schedule a complimentary 15-minute consultation.

This article was updated in January 2024 for relevancy.