Retirement is a golden chapter many eagerly await, brimming with dreams of relaxation, exploration, and newfound passions. Identifying your retirement strategies early on is a must. But to truly savor this stage of life, careful planning is essential. As you approach this milestone, safeguarding your financial future should be a major focus.

Sustaining your savings through retirement involves a blend of foresight, discipline, and strategic decision-making. With the right strategies and advice, you can confidently embark on this journey and enjoy the fruits of your labor without financial worries.

Let’s examine some key steps to help you understand how to prepare for retirement and sustain your retirement savings effectively

Start Early, Save Consistently

One of the first steps to retirement lies in early planning. The power of compound interest works wonders over time, making early savings immeasurably valuable. Start contributing to retirement accounts such as 401(k)s, IRAs, or employer-sponsored plans as soon as possible.

These accounts offer tax advantages and investment options to help your savings grow more efficiently. Consistent contributions can grow substantially over the years, even if they seem small initially. Automate your savings whenever possible to ensure regular deposits.

Set Clear Goals

Understanding your retirement needs is crucial for effective planning. Take stock of your current financial situation, projected expenses, retirement timeline, and desired lifestyle in retirement. Factor in potential healthcare costs, leisure activities, and any other expenses unique to your circumstances. With this information, you’ll be prepared to make smarter investment decisions.

Diversify Your Investments

Diversification is a cornerstone of investing, especially as you near retirement age. To minimize risk, spread your investments across different asset classes, such as stocks, bonds, real estate, and cash equivalents. A well-balanced portfolio can help cushion against market fluctuations and preserve your savings over the long term. A financial advisor will help you tailor your investment strategy to your risk tolerance and retirement timeline.

Withdrawal Rates in Retirement

Withdrawal Rates in Retirement

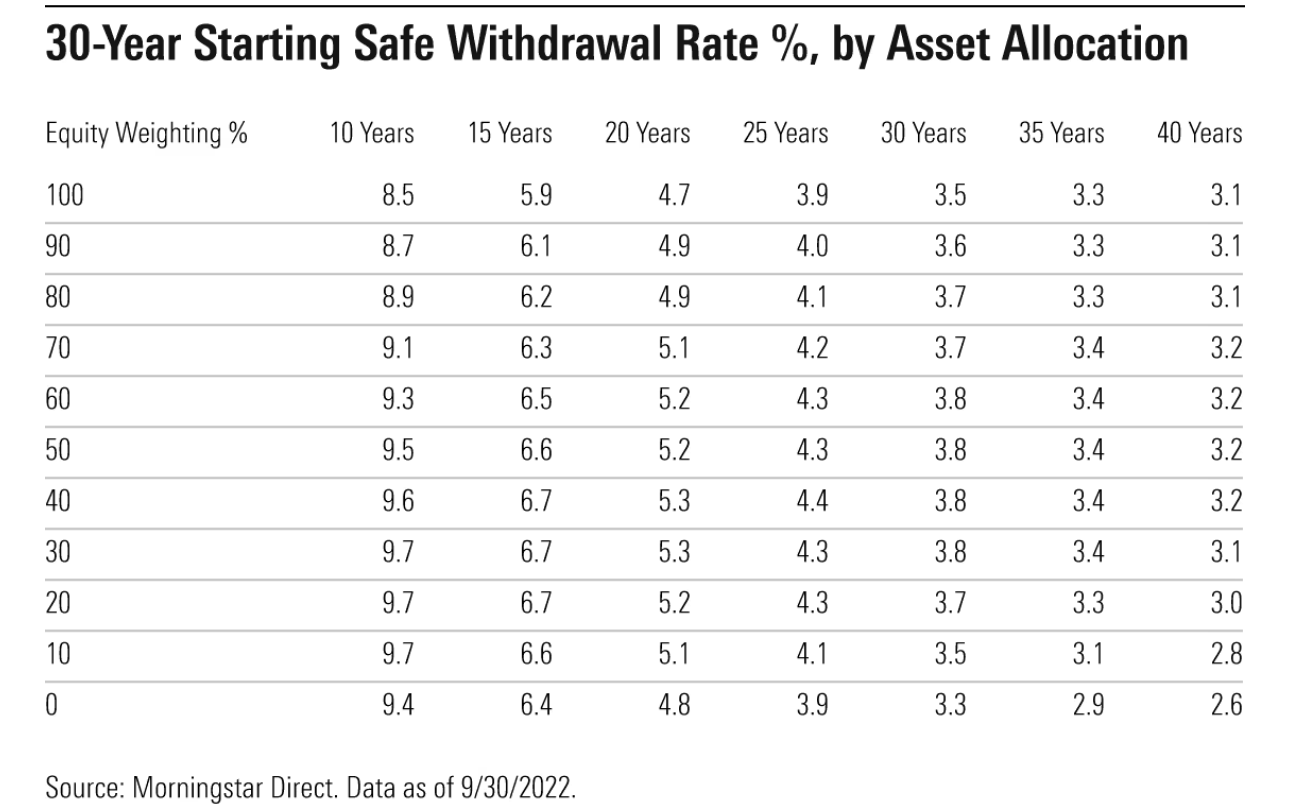

A common strategy for withdrawal rates in retirement is the 4% rule. The rule says that withdrawing up to 4% of your portfolio yearly allows retirees to sustain their income without depleting their funds over a 30-year retirement period. However, recent research suggests that the safe withdrawal rate for retirees may be increasing.

This uptick is attributed to higher fixed-income yields and a more favorable long-term inflation estimate. By optimizing withdrawal rates based on market conditions, retirees can maintain financial stability throughout retirement.

It is important to continually monitor your portfolio and market conditions to ensure financial security in your retirement.

Take Advantage of Catch-Up Contributions

Catch-up contributions offer a valuable opportunity for individuals aged 50 and older to bolster their retirement savings. Once individuals reach this age, they become eligible to exceed the standard contribution limits for retirement accounts such as IRAs and 401(k) plans.

This provision allows individuals who may not have been able to save as much as they desired earlier in their careers to make up for lost time and accelerate their retirement savings during the critical years leading up to retirement. By taking advantage of catch-up contributions, individuals can bridge the gap between current savings levels and retirement goals, maximize tax advantages, and strengthen their overall financial well-being.

Plan for Healthcare Costs

Healthcare expenses can escalate in retirement, making planning for potential medical needs essential.

If needed, research Medicare options and supplemental insurance plans to ensure adequate coverage for healthcare services, prescription drugs, and long-term care. Consider setting up a health savings account (HSA) to cover out-of-pocket medical costs tax-free.

Incorporating medical expenses into your retirement budget can prevent unforeseen financial burdens.

Adopting a Flexible Retirement Strategy

Flexibility is the key to successful retirement planning, particularly in response to changing market conditions and personal circumstances. Retirees should remain open to adjusting their withdrawal strategies and investment allocations to adapt to evolving situations.

By embracing flexibility and staying informed about market trends, retirees can optimize their retirement income and maintain financial security over the long term.

Steps To Retirement

Developing retirement strategies and planning is a dynamic process that requires careful planning and consideration of various factors, including financial goals, risk tolerance, and market conditions. By starting early and following a strategic approach to investing, retirees can optimize their retirement income and sustain their savings over the long term.

Aligning risk tolerance with investment goals, maximizing safe withdrawal rates, leveraging TIPS for inflation protection, seeking professional guidance, and staying informed are key components of a well-rounded retirement blueprint.

With careful planning and informed decision-making, individuals can enjoy retirement confidently, knowing their financial future is secure.

Professional Retirement Guidance

Navigating the complexities of retirement planning can be daunting, and seeking professional guidance can provide invaluable support. At Stableford Capital, we offer personalized advice tailored to individual goals and circumstances, helping you make informed decisions and optimize your retirement income.

With guidance, you can make informed decisions and optimize your retirement income, ensuring a secure and fulfilling retirement. Call us at 480.493.2300 or contact us to schedule a complementary 15-minute consultation.