In the intricate world of financial planning, navigating the tax landscape is a critical aspect for astute investors, particularly as we approach 2024. Amidst evolving tax laws and economic shifts, understanding and leveraging tax policy changes become pivotal in safeguarding wealth and fostering growth.

This blog offers a comprehensive exploration of tax-centric financial strategies tailored for the upcoming year, providing valuable insights for those seeking to optimize their financial portfolios.

Reflections on 2023: A Tax Perspective

The fiscal landscape of 2023 was marked by significant policy shifts. Despite the Federal Reserve’s rapid monetary tightening, government-sponsored fiscal stimulus from pandemic policies counteracted potential negative wealth effects.

This created unique tax planning opportunities, underlining the importance of staying abreast of policy changes and their implications for personal wealth.

The Tax Environment in 2024: Navigating New Norms

Entering 2024, the tax environment is one of cautious anticipation. Given the historical pattern, significant legislative changes in tax laws during a national election year are unlikely. The current administration seems to be maintaining this trend, with no major tax law revisions anticipated for 2024.

Entering 2024, the tax environment is one of cautious anticipation. Given the historical pattern, significant legislative changes in tax laws during a national election year are unlikely. The current administration seems to be maintaining this trend, with no major tax law revisions anticipated for 2024.

However, here are the tax environment changes we know are coming this year:

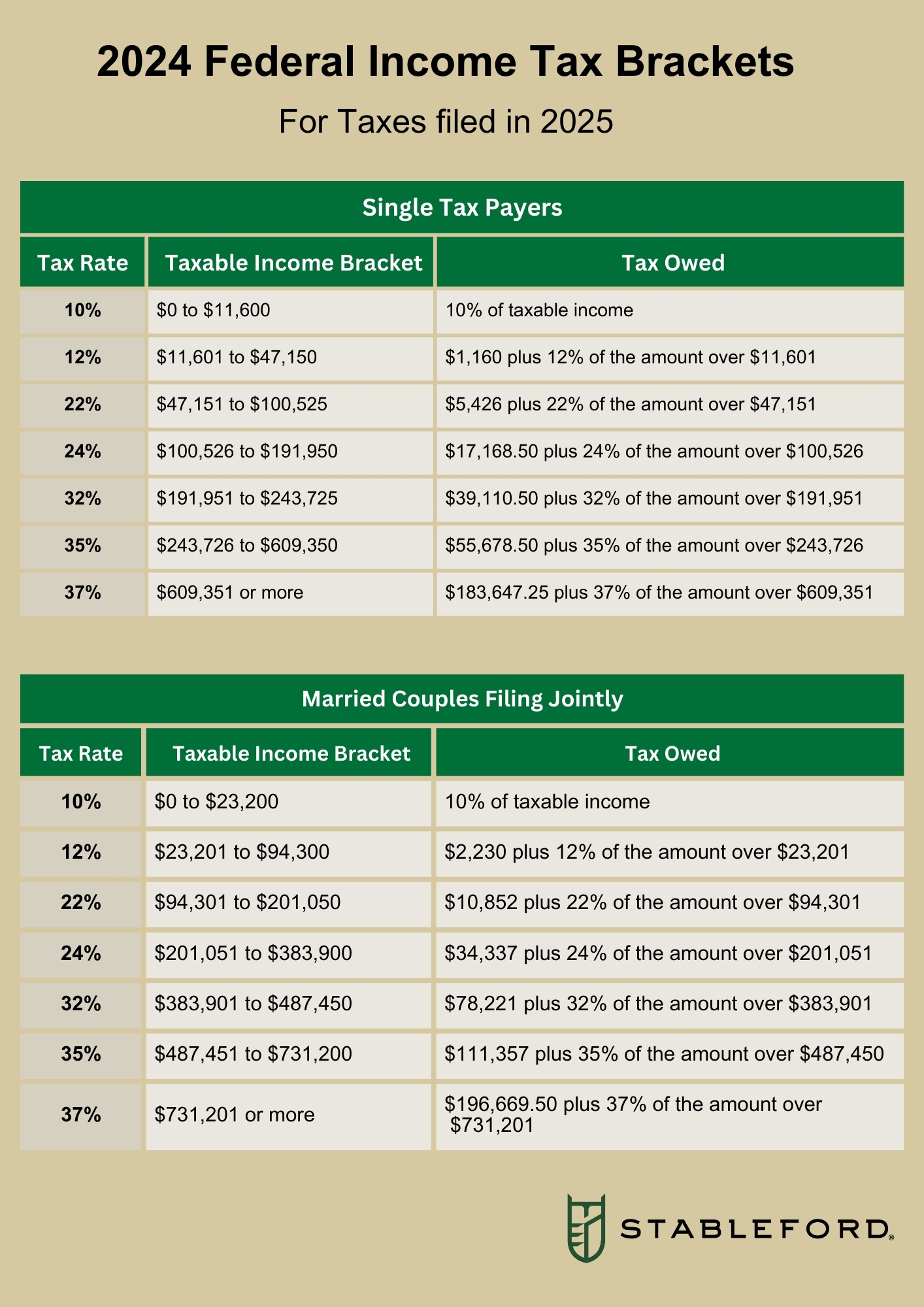

- Tax brackets adjusted to reflect inflation: On average, roughly $30-$40K upward for each bracket and filing status.

- Standard deduction increases: Deduction goes up $750/single, $1,100/Head of household, and $1,500 for Married filing jointly

- 401K contribution increases: The employee contribution maximum will increase to $23,000.

- Annual gift exclusion: Gift exclusion will increase to $18,000.

- Phase out limits for IRA’s: Roth IRA’s and Saver’s Credit all go up in 2024.

It is also important to note that the tax reductions implemented under the Trump administration are scheduled to expire in 2025 unless renewed by Congress. The outcome of the forthcoming election will be a decisive factor in shaping the future of these tax policies, emphasizing the need for individual investors to stay informed and prepared for potential changes in the tax environment.

Key Tax Strategies for 2024

Understanding how household balance sheets and credit trends influence tax strategies is crucial. Additionally, potential shifts in corporate profits and market dynamics, make tax-efficient investment strategies increasingly vital.

Effective navigation of the tax landscape in 2024 requires these tax-centered approaches:

- Organize and Review Financial Records: Centralizing financial records, including tax documents and investment statements, is key. Regular expense tracking helps identify potential tax-saving opportunities.

- Tax-Efficient Investment Assessment: Evaluating investment portfolios with a tax lens is critical. Focus on strategies like tax loss harvesting to manage capital gains and align investments with current tax scenarios.

- Maximizing Tax Savings: Staying informed about changes in tax brackets and deductions is essential. Utilize strategies like bunching itemized deductions and maximizing gift tax exclusions to optimize tax liability.

Retirement and Estate Planning: A Tax-Focused Approach

All aspects of wealth management benefit from a tax-focused approach, including retirement and estate planning. For investors intending to update their retirement and estate plans this year, here are some aspects of a tax-focused approach to consider

- Gifting appreciated assets.

- Exercising vested incentive stock options before 2026.

- Make Charitable Contributions using Qualified Charitable Distributions (QCD) from an IRA. This results in the IRA distribution not being included in Adjusted Gross Income and avoids all tax on the distribution

- Managing itemized deductions by bundling large deductions in the same year.

- Accelerating income into years before 2026 to take advantage of lower tax rates.

- Increasing the pace of lifetime gifting during the current enhanced exemption levels.

Tax Calendar for 2024: Key Dates and Deadlines

Staying ahead of tax deadlines is vital. Keeping track of important dates like tax return submissions, estimated tax payments, and retirement account distributions can help avoid penalties and optimize tax planning.

You can find a draft of the 2024 IRS Tax Calendar here.

Integrated Financial Advising: The Role of Tax in Wealth Management

Tax planning and advising play a pivotal role in wealth management by strategically minimizing tax liabilities and maximizing financial gains. An individual’s tax planning should align with specific financial goals like wealth preservation, asset growth, retirement planning, and intergenerational wealth transfer.

Stableford Capital’s integrated approach to financial advising, encompassing financial counseling, tax planning, and asset management, is designed to provide comprehensive, tax-optimized solutions. A coordinated approach to these elements is essential for effective wealth management.

Proactive Tax Planning for a Prosperous 2024

In a world where financial markets are dynamic and tax regulations are in constant flux, the ability to tailor wealth management strategies to your unique circumstances is indispensable.

Stableford Capital recognizes that one size does not fit all. This is why we embrace a customized approach to advisory services and investment strategies. This personalized touch extends beyond mere asset allocation, incorporating a meticulous integration of tax strategies into every facet of your financial plan.

Reduce the stress and frustration surrounding taxes this year. With Stableford’s integrated advisory services you can maximize your tax savings and ensure your tax plan aligns seamlessly with your broader financial goals. Call 480.493.2300 or contact us to schedule your complimentary 15-minute consultation.