Navigating risk is an unavoidable aspect of investing. However, you can build your legacy while effectively managing that risk with the right strategy.

The concept of risk-adjusted returns measures an investment’s return against the risks taken to achieve it. This helps investors gauge whether the risks they are taking are commensurate with the expected outcome.

Managing risk to safeguard your legacy while capitalizing on opportunities for growth is the cornerstone of Stableford Capital’s unique investment philosophy. In this blog, we’ll delve into why risk-adjusted returns are vital in today’s market landscape.

The Necessity of Dynamic Investment Strategies

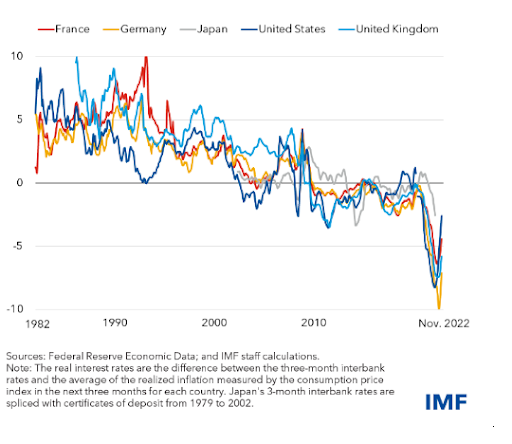

The investment world is at a pivotal point with the end of the 40-year decline in interest rates. Traditional investment strategies, particularly in bonds, are losing their effectiveness as inflation risks and interest rates become more volatile. The correlation of equity and bond returns is increasing, heightening the risk of drawdowns in multi-asset portfolios.

The Decline of Bond Reliability

The past 40 years have seen a steady decline in interest rates, significantly impacting bond investments.

Now, with diminishing returns from bonds, there’s an urgent need to seek alternative stable return sources.

Increasing Correlation Risks Between Equities and Bonds

An emerging trend is the growing correlation between equity and bond returns. This phenomenon poses significant challenges for traditional multi-asset portfolios.

At Stableford Capital, we adopt a dynamic and balanced approach to portfolio management, focusing on volatility control for better risk-adjusted returns.

Clients benefit from an active team of asset managers employing sophisticated, proprietary risk management strategies to improve performance while minimizing risk.

Understanding Risk-Adjusted Returns

Risk-adjusted returns are crucial in wealth management, measuring an investment’s return in relation to the risk taken to achieve it. This metric helps investors determine whether the risk undertaken is justified by the expected reward.

Several of the most commonly used measurements in risk-adjusted return methods include:

- Sharpe Ratio

- Treynor Ratio

- R-Squared

- Beta

Every investment carries some level of risk. It takes an experienced and prudent advisor to understand these methods and properly apply them in current market conditions in order to produce the best returns for investors.

Every investment carries some level of risk. It takes an experienced and prudent advisor to understand these methods and properly apply them in current market conditions in order to produce the best returns for investors.

Beyond market experience is the relationship. A key factor to ensure the success of an investment strategy is the understanding of the client’s preferences and their changing circumstances.

The financial needs and values of each client are unique and shouldn’t be solved with standard solutions. Stableford customizes specific solutions to align with the goals of our investors through a highly personalized five-step process.

Balanced versus Defensive Investment Approaches

A balanced approach is preferable over a purely defensive strategy for risk management, achieving both capital preservation and growth.

This strategy aims to harmonize risk and return by mixing different asset classes within a portfolio. Typically, balanced portfolios are allocated between bonds and stocks in either an equal distribution or with a slight bias, such as a 60% allocation in stocks and 40% in bonds.

A balanced portfolio reduces overall risk and is managed with the goal of stable risk-adjusted returns, differing from strategies that rely solely on defensive assets.

The Importance of Active Portfolio Management

While finding the right balance of an active vs. passive investing approach is paramount, in today’s intricate financial markets, the limitations of passive diversification are increasingly evident. Active portfolio management stands out as a critical component in adapting to the fluctuations and complexities of the market.

Choosing the best approach for each client is part of the personalized investment process at Stableford. With a firm philosophy that seeks to achieve more stable risk-adjusted returns, an active management approach is usually preferred. This allows for timely adjustments in the asset mix to capitalize on emerging opportunities and mitigate risks.

Stableford Capital leverages unique strategies, honed through decades of institutional experience in complex markets and supported by thorough research, with the goal of optimizing returns for our clients while diligently minimizing risks.

With this approach, an active manager’s role is crucial in continuously monitoring market movements, adjusting asset allocations as needed, and managing risks effectively. Working this way ensures that a portfolio reflects the investor’s risk tolerance and is not just reactive, but strategically positioned for both current and future market conditions.

Hands-On Approach

At Stableford, all the allocating and trading is done in-house. This is important because it gives us control over when, why, and where things happen. Stableford advisors play a hands-on role in continuously researching, executing, and managing your portfolios.

We can actively change allocations and adjust how much bond exposure or equity exposure a portfolio has depending on what’s happening in the markets while keeping you informed at all times.

Build Your Legacy with Confidence

Adapting your investment strategy to current market conditions is more important than ever. At Stableford Capital, we use sophisticated institutional strategies and dynamic asset allocation tailored for individual investors, along with a proprietary risk management process.

Trust can’t be built — it can only be earned. Stableford Capital is committed to earning your trust through consistent feedback, a data-driven process, and results.

For personalized wealth management services that align with your goals and risk tolerance, contact Stableford Capital at 480.493.2300 or through our contact page. We will help you build your legacy with confidence and peace of mind.