There is a time for bottoms-up stock picking and fundamentals, but there is also a time for technical analysis. And the three investment management strategies are not mutually exclusive. In fact, Stableford Capital covers all three disciplines within its asset management team and they often work best together.

Technical Analysis as Part of Investment Management Strategies

The technical approach, like all investment approaches, has strengths and weaknesses. The major factors are experience and understanding the limits of the craft.

The pure fundamentalist must understand there is more to a good investment decision than simply finding companies with good fundamentals.

The pure value investor must understand that what appears to be a good value can become an even better value, meaning the price falls significantly, before the value factor becomes irresistible.

A pure technician must understand that there are many factors driving the technical picture in focus. In theory, the technical picture is expected to change before changes occur in fundamental and value factors. However, a change in the technical picture does not mean a change in the other factors is necessarily taking place.

Case in point, when the Chinese currency weakens sharply (moves higher), the S&P 500 tends to correct. It isn’t the level, but the rate of change that is important, as depicted in this chart:

If we see CNY move sharply and the S&P reacts negatively, then we can adjust our positioning appropriately. Once the currency move settles down, we expect the S&P 500 to return to trend.

While there are many factors moving prices around, this one is easy to spot as it is happening, and that helps Stableford “cut through the noise.”

“If you don’t use the tools correctly, they can work against you.” -Jim Patterson

Stableford Strategies

At Stableford, the good technician enhances both the fundamental and macro aspects of the investment management strategy. Like warning lights on your car’s dashboard, the technician is focused on continually confirming the narrative trends, specifically noting when the technical trends are no longer moving in unison with the consensus narrative.

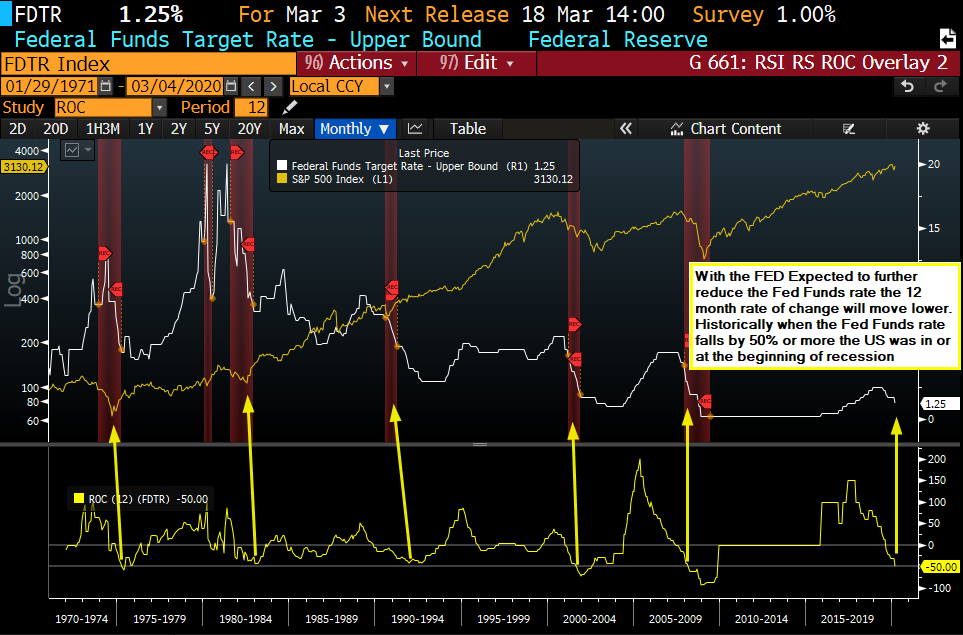

For example, see the chart below (note that this is dated March 3, 2020 – before the peak of the COVID-19 pandemic). It shows the Federal Funds rate, its 12-Month Rate of Change and U.S. Recessions. The overarching message from this chart is that a U.S. recession is likely, and stocks tend to go down during U.S. recessions. Thus, this analysis supports Stableford’s conservative posture, which focuses on the downside risk first.

In our dashboard comparison, this is a warning light indicator.

At Stableford, technical analysis informs the portfolio management process rather than drives it. Technical analysis only makes a difference because our asset management leaders have been able to use the analysis within the context of our investment management strategies. To learn how these strategies may fit into your investment road map, contact us online or call 480.493.2300.