For the past 10 years the Federal Reserve has been researching central bank digital currency(CBDC), colloquially referred to as “Fedcoin.” In March of 2022, President Biden signed an executive order for federal agencies to more urgently research crypto regulations and explore plans to implement a CBDC in the U.S.

The first step in that process is the introduction of the FedNow Service: a real-time digital payment system that The Federal Reserve estimates could launch as early as May 2023.

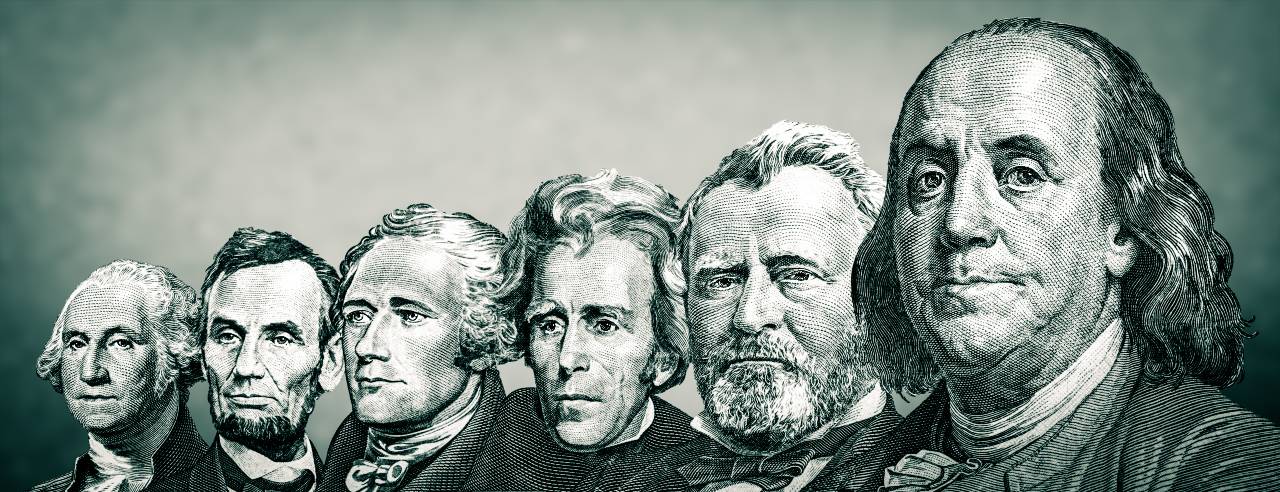

Brief History of U.S.Currency

On the surface, Fedcoin may seem so unconventional that it’s difficult to imagine. However, this wouldn’t be the first time our currency has changed.

In the early days of the United States, the “Continental” currency was issued in 1775 to help fund the Revolutionary War. Six years later the notes became worthless and they ceased to be circulated.

There have been other more recent changes to our system of currency, including:

- The creation of the Federal Reserve in 1913.

- Roosevelt confiscated gold in 1933.

- Johnson took silver out of U.S coinage in 1965.

- Nixon devalued the dollar and detached it from gold in 1971

Not preparing for change is not knowing history. The next currency change may quite possibly lead to something like a digital-only currency.

What are FedNow and Fedcoin?

FedNow is an instant payment service that will enable commercial banks to provide payment services to individuals and businesses 24 hours a day, every day. Recipients would have immediate access to the transferred funds, making digital payments faster and more convenient. This system will also be less expensive than wire transfers and debit card transaction fees.

For now, this service will settle in commercial bank money, but in time, it may migrate to central bank money if and when it is introduced.

“Fedcoin” would be a central bank digital currency (CBDC): “a digital liability of a central bank that is widely available to the general public”.

Simply put, it is a digital dollar that will be issued and backed by America’s Federal Reserve. When this digital dollar becomes a liability of the Fed it will be the safest digital asset available to the public.

Simply put, it is a digital dollar that will be issued and backed by America’s Federal Reserve. When this digital dollar becomes a liability of the Fed it will be the safest digital asset available to the public.

A CBDC will not be a new currency, but rather a digital form of the current U.S. dollar. It differs from existing digital money-debit/credit cards because a CBDC is centralized and not part of the commercial banking system. Though some concerns remain.

Advocates at the National Consumer Law Center, National Consumers League, and National Community Reinvestment Coalition warn that the rules announced May 17 of this year lack protection against scams and fraud, which, if unaddressed, could leave consumers exposed when the payment service launches next year

How is a CBDC Different from Bitcoin?

A CBDC is not the same as Bitcoin. It’s a digital currency, but it’s not a cryptocurrency. There are several important distinctions:

- Cryptocurrencies are mostly unregulated, whereas a CBDC is regulated by the central bank.

- Cryptocurrency, like Bitcoin, operates on a blockchain-based accounting system. Central accounting is used with CBDC, but the use of distributed ledger technology, like blockchain, is being considered.

- Bitcoin currency is created mathematically and capped at 21 million coins. It is issued by“miners,” the people who run and process Bitcoin code to ensure transactions are properly added to the blockchain. CBDC currency is based on the underlying currency and is issued by the central bank.

- Crypto purchases are pseudo-anonymous, but every transaction with a CBDC is tracked to ensure transparency and inhibit illicit activity.

Benefits and Risks of a Centralized Digital Dollar

In January 2022, the Federal Reserve published a paper outlining the potential benefits, risks, and challenges of a CBDC. The paper also served to open a public discussion about implementing a CBDC in the U.S. and collected feedback on a range of topics related to CBDCs until May of 2022, all of which are now publicly available.

Potential benefits of a centralized digital dollar include:

- Ensure the dollar remains the top reserve currency for the global economy.

- Improve cross-border payments.

- Increase financial inclusion.

- Quick, secure payments.

- Ease of use.

With a digital currency, you wouldn’t have to make bank runs anymore. Financial assistance could be directly deposited into accounts for immediate use. A CBDC would streamline the payment process by removing intermediaries and eliminating transaction fees.

While these benefits appear attractive, there are also risks associated with a CBDC.

- If individuals held accounts directly with the Fed, interest rates could be directly set in the account including negative interest rates (essentially a tax to hold money in the account).

- Digital-only payments risk privacy and data protection.

- A CBDC could have a destabilizing effect on the financial sector.

- Digital currency is at higher risk for abuse by authoritarian governments, as seen recently in Venezuela.

Clearly stated in the recently published Fed document, if a CBDC were implemented in the U.S., it would need to be privacy-protected, intermediated, widely transferable, and identity-verified to best serve the needs of the country.

What is the Plan?

After President Biden’s executive order, the Fed has quickly transitioned from the research phase into an implementation phase working with MIT to launch FedNow by May 2023.

What will happen after this digital payment system is introduced?

Will the Fed establish Fedcoin as a second alternative currency to the paper dollar? Or will they convert the current money supply onto the blockchain and gradually remove paper currency from circulation?

Specifics of how digital dollars will work for consumers are also unclear–for example:

- How do I actually earn using this system?

- How quickly will cash go away and how long will consumers be able to still use it

- What about those who lag behind with technology?

- Will consumers have any choice to opt-in or out?

- Is no interest rate viable?

There are no clear answers (yet). However, never in the history of the world has a fiat paper-only currency, like the U.S. dollar, survived more than 30-40 years.

What’s Next?

The Fed declared that it would not proceed with the issuance of a CBDC without clear support from both the executive branch and Congress.

Over one hundred countries around the world, representing over 95% of the global GDP, are researching a CBDC as well as alternative international payment systems.

Ten countries have already fully launched a digital currency, and China’s CBDC pilot is set to expand in 2023.

It doesn’t take a lot of imagination to see the end of the road of paper money, as well as the potential risk to political and economic freedoms that may come as a result

Ultimately, Stableford will continue to monitor the changes and ensure our clients are informed and ready for the changes as they roll out.