Generative AI is a rapidly advancing technology that has garnered widespread attention across all industries and markets. With a projected growth from its current $100 billion stature to a staggering $2 trillion by 2030, it’s a twentyfold increase that demands attention.

Yet, as seasoned investors know, enthusiasm alone does not guarantee wise or safe investments.

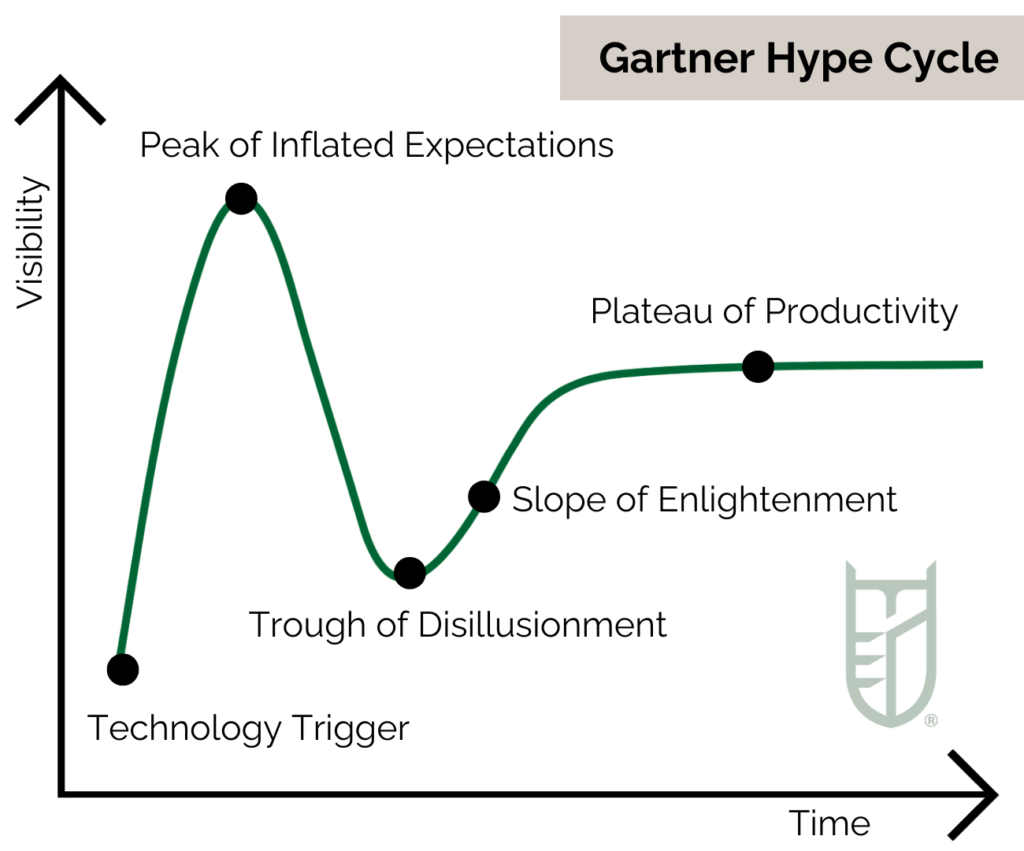

When considering investing in companies that leverage AI technologies, it is essential to consider the Gartner Hype Cycle and AI’s position within that framework. The Gartner Hype Cycle recently placed generative AI on the ‘Peak of Inflated Expectations’ – information which should be thoughtfully considered to inform investment strategies and decisions.

Stableford Capital maintains a vigilant eye on industry trends, ensuring our asset managers remain well-informed about AI developments. This enables us to exercise prudence and discernment in selecting the stocks and investment opportunities we recommend for our clients’ portfolios. Here is what you should know about the current state of generative AI investments.

The Gartner Hype Cycle: Understanding the Framework

The Gartner Hype Cycle is a valuable framework used to assess the maturity and adoption of emerging technologies. It provides a structured approach to understanding how technologies evolve over time, from inception to integration into mainstream usage.

Stages of the Hype Cycle

Technology Trigger: This is the initial stage where a new technology captures the attention of the market. In the case of AI, this was the period when AI research and development started gaining significant momentum.

Peak of Inflated Expectations: This phase is marked by excessive optimism and hype surrounding the technology. Expectations often exceed what the technology can realistically deliver.

Trough of Disillusionment: As the initial hype subsides, the technology faces challenges and setbacks. This is a critical phase where the real-world limitations and difficulties become apparent.

Slope of Enlightenment: In this stage, successful use cases emerge and a more realistic understanding of the technology’s potential takes hold.

Plateau of Productivity: Finally, the technology reaches a stage of maturity where it is integrated into various industries and its benefits are widely realized.

Generative AI on the ‘Peak of Inflated Expectations’

The last decade witnessed a remarkable surge in AI research and development, leading to groundbreaking advancements in machine learning and deep learning. This AI boom was the technology trigger stage.

As recent high-profile successes in areas like image recognition and natural language processing moved rapidly into the forefront, AI garnered immense attention, resulting in inflated expectations about its capabilities. As of the latest assessment, generative AI is positioned on the ‘Peak of Inflated Expectations,’ indicating that while it holds immense promise, there may still be a gap between expectations and practical implementation.

AI’s position in the Hype Cycle is influenced by factors such as technological advancements, regulatory developments, and the emergence of successful AI-driven business models. As AI is applied to more complex tasks, it’s expected that these technologies will encounter challenges such as ethical concerns, bias, and scalability before seeing marked success in real-world applications and, eventually, mainstream adoption.

Stableford Capital remains steadfast in our commitment to closely monitoring the ever-evolving landscape of AI technologies while consistently assessing its potential impact on clients’ portfolios and investment strategies.

Impact on Investment Strategies and Portfolios

Understanding the evolution of AI and its progress through the Hype Cycle is crucial for both investors and wealth managers when it comes to investment strategies, as well as building and managing client portfolios.

Aligning AI Investments with Clients’ Financial Goals

Stableford wealth managers recognize the importance of aligning potential AI investments with clients’ financial objectives – tailoring investment strategies to balance risk and reward aids in ensuring that new investments complement existing portfolios.

It is essential for investors and wealth managers to discuss the criteria and due diligence required to assess AI companies and technologies effectively and determine their investment viability.

Opportunities and Risks Associated with AI Investments

There are many potential generative AI investment opportunities from tech giants and startups creating new technologies and applications to companies that specialize in collecting, storing, and processing the data that fuels AI algorithms.

There are many potential generative AI investment opportunities from tech giants and startups creating new technologies and applications to companies that specialize in collecting, storing, and processing the data that fuels AI algorithms.

While AI has exciting investment potential, it also presents risks related to market volatility, regulatory changes, sustainability, and the unpredictability of emerging technologies.

For example, one risk associated with AI investment is the potential for regulatory backlash. As AI systems become more prevalent and the impact on society more apparent, governments around the world are grappling with how to regulate this emerging technology. This could lead to new laws and regulations that limit the growth of AI or impose additional costs on companies that rely on it, potentially impacting the return on investment.

The risks and fluctuations inherent in AI and other emerging technologies require an asset manager with a prudent investment philosophy who takes an active and communicative role in regularly reviewing and adjusting client portfolios.

Stableford’s Investment Strategies

Unique, ever-changing wealth considerations demand an asset manager who is flexible and dynamic. That’s why Stableford Capital designs investment strategies and makes recommendations based on clients’ unique goals, values, and financial situation.

One of the aspects that sets Stableford apart is its unique investment philosophy, focusing on downside protection first and then potential appreciation second. This is crucial for investing in companies that leverage AI because the technology is still evolving and progressing through the hype cycle, making it a more unpredictable, and therefore risky, investment.

Stableford’s goal is to protect and grow clients’ wealth by investing in high-quality, capital-compounding companies with a sustainable competitive edge, experienced management teams, and a strong track record of capital allocation and smart decision-making.

Clients appreciate the hands-on role in continuously researching, executing, and managing portfolios while staying informed at all times. This customized, active approach increases confidence and helps maximize financial success.

Bottom Line for Investors

Generative AI is an exciting and rapidly evolving development across industries. Although the potential of AI technologies makes investing an enticing opportunity, it is essential to consider AI’s evolution and current status on the Hype Cycle to determine whether or not it complements your risk tolerance, goals, and overall portfolio.

To learn more about how Stableford Capital can customize an investment strategy to build and preserve your legacy, call 480.493.2300 or contact us to schedule your complimentary 15-minute consultation.