Banks push inflation off the front page

Wow, what a month. Banking woes pushed the 24/7 inflation watch to the back pages for the first time in a year. Financial stability fear is the first real push-back to the relentless Fed rates hikes, and it is having real impact. Early in March it seemed the Fed was on its way to re-accelerating to a 50 basis point increase. But the bank deposit crisis caused the Fed to slow in order to maintain financial stability.

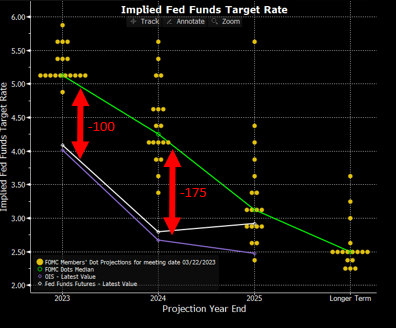

Meanwhile, bond markets have completely diverged from Fed guidance. As seen in Exhibit 1, market implied Fed Funds rates are 100 basis points under the Fed governors’ median rate at the end of 2023, and nearly 175 basis points below for 2024.

Clearly the market believes that the Fed will need to begin cutting rates soon, as evidenced by the 46 basis point drop in 10-year U.S. Treasury yields during March. This is a significant change that puts the Fed and markets at loggerheads: Bond markets believe that the Fed needs to reverse course at the risk of recession, while the Fed remains steadfast in raising rates to corral inflation.

Despite the bond market fears, equities rose 3.5% during March. Perhaps stocks are whistling past the graveyard, as much of the increase was driven by a rotation into tech names with heavy weightings in the S&P 500. Some of the increase makes sense, as lower rates disproportionately aid valuations of higher growth tech names. The key to maintaining valuations in the future will be earnings.

Stableford’s View

We tend to agree with the bond market’s view that the Fed will likely need to pause / pivot soon. While we might quibble with the magnitude of the moves in rates, it is becoming clear that the Fed should not (cannot) move much higher without collateral damage.

The good news is that we are getting closer to the end of the cycle where there should be much more opportunity for lower priced equities once there is a reduction in earnings and we are poised to take advantage of this.

We have been rotating into bonds this year in anticipation of higher risks and volatility. Our bank exposure is low and focused on large caps, to the extent that we have any exposure. Current economic data remain fine, but are starting to hint at a slowdown through factory orders and backlog.

As this plays out, we like our positioning heading into a slowdown and look forward to brighter days when we can scoop up high quality companies at lower prices.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.