A lot of effort…with little real change

Ever feel like you are running really fast but not getting very far? April was that kind of month.

After recovering from the banking kerfuffle in March, the S&P 500 moved in a much narrower range during April and eked out a 1.5% gain for the month.

Some bank fears re-emerged at the end of the month around First Republic, indicating there are still issues to be dealt with. This makes sense to us. We believe that while the deposit issues appear largely contained in regional banks for now, there are plenty of issues around regional banks and commercial real estate that will take time to emerge. First among them is the still unknown depth and impact of credit contraction as banks reduce lending; something to keep an eye on.

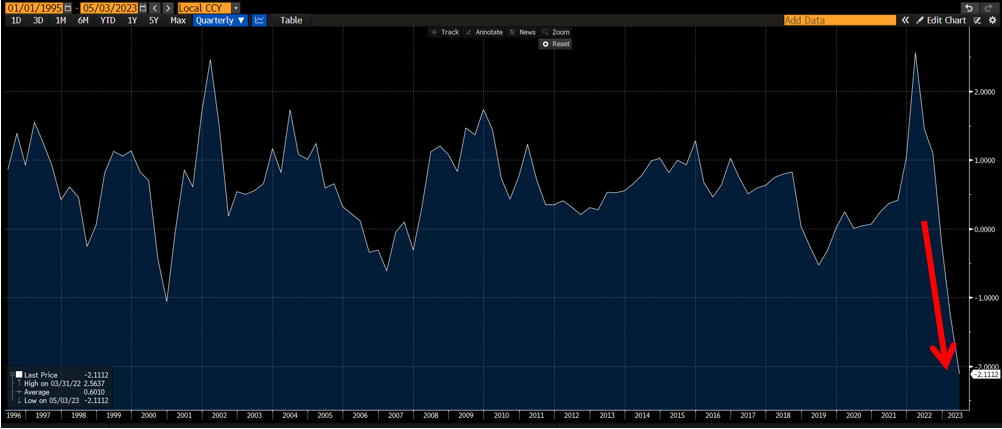

Meanwhile, Fed Chair Powell’s favorite short term rate indicator is at a record low. The difference between the 18 month forward 3-month rate and current 3-month rate (the market’s estimate of what 3-month rates will be in 18 months minus current 3-month rates) hit a new low of -211 basis points. This means traders believe that 3-month rates will be ~ 2.93% in 18 months compared to 5.04% now. It reflects a belief that economic growth will falter, forcing the Fed to drop rates significantly, which differs significantly from the Fed’s own views that rates will stay higher.

Bond markets continue to have a much different view of the economy than equities. 10-year U.S. Treasury yields remain inverted, significantly below shorter-term rates at 3.42%, a minimal change from March. Inversion is the bond market’s signal that future growth will slow.

Stableford’s View

So, who is right, bonds or equities? It is hard to know and much of it depends on timing.

Fed rate increases are largely done, for now. However, we can see a scenario where inflation remains persistent and the Fed increases rates again, after a pause to ensure financial stability.

Meanwhile, the economy continues to grow, albeit at a decelerating pace. Labor demand remains incredibly strong as well. We maintain our view that the end of the cycle is approaching, when there should be ample opportunities for lower valuation equities. Even now, we are starting to find some companies that have already taken their pain and trade at reasonable valuations.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.