Mid-Year Checkup

What happened in the first half of 2023?

The first half of 2023 was surprising because when the Fed has tightened this quickly in the past it has led to significant economic downturns due to a negative wealth effect. Typically, as short-term rates rise, individuals increase their personal savings to take advantage of the higher rates. This leads to lower asset prices, housing deceleration, and less revenue available to companies, which causes layoffs and a negative economic cycle and often punctuated by a recession. What has been different this time?

This time, enormous fiscal stimulus from government-sponsored pandemic policies transferred wealth that more than offset the negative effects. These effects have been larger and longer lasting than anticipated. People had so much money in savings that they were willing to spend, rather than save as they typically do. And companies have thus far largely struggled to keep up with demand, which has led to higher prices and better profits.

The setup now is interesting. Demand for goods has begun to wane while services demand has likely peaked and is decelerating, though still positive. Household balance sheets are weakening, and credit card utilization and defaults are rising. Neither are at critical levels yet, but some consumers, particularly at low-income levels, are starting to struggle.

Given this setup, could corporate profits keep rising? Sure, it is possible. But the odds are that they will slow. They need not crater, but certainly slow down. Add to that rising rates and extremely rich multiples and it becomes difficult to envision large levels of upside for equities.

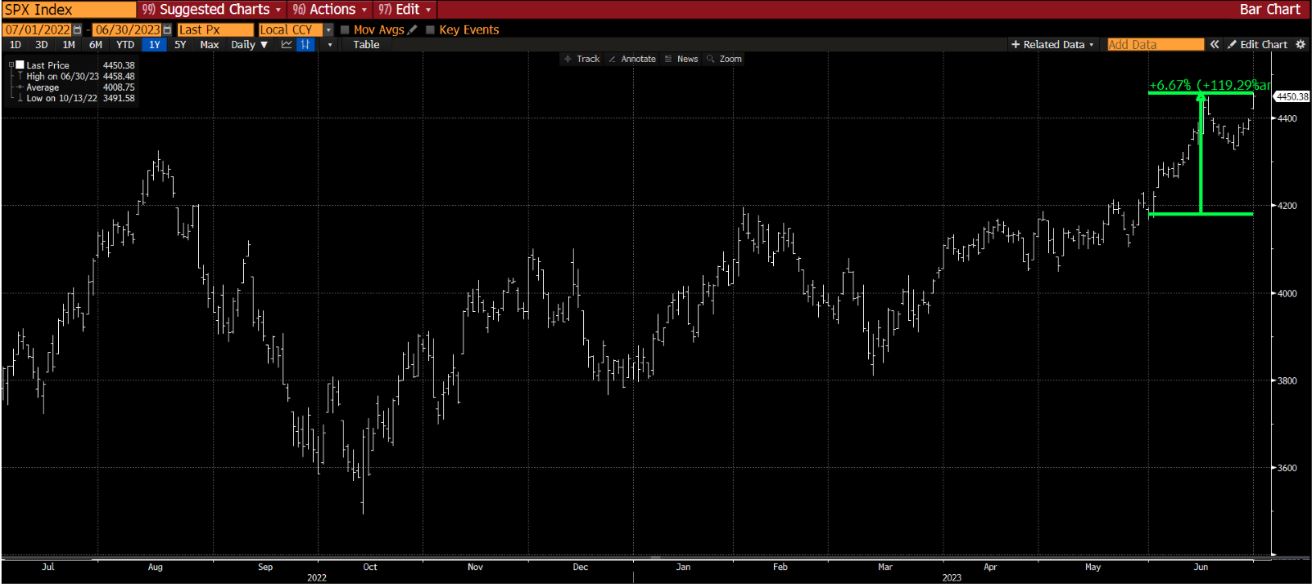

Despite this backdrop, equities were up 6.7% during June, once again driven by a few large-cap tech stocks. While the strength is surprising to almost everyone that has any gray hair, it remains in place. Excess liquidity is driven by government pandemic largesse and (of late) new Fed lending facilities to avoid bank runs keep the music playing. If it seems odd to you that the Fed can desire to slow the economy on one hand yet create new lending facilities that drive assets higher on the other, you’re not alone.

Meanwhile, during June the 10 Yr. US Treasury yield increased 19 basis points to 3.84%. The biggest rates news during the month was the “hawkish skip” where the Fed indicated they were likely to resume increasing rates at future meeting. This had the effect of moving rates up across the curve and pushed out most estimates for rate cuts to 2024.

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.