September redux

October was much like September: Rates up, stocks down. But there was the added pressure of earnings results which weighed on stocks.

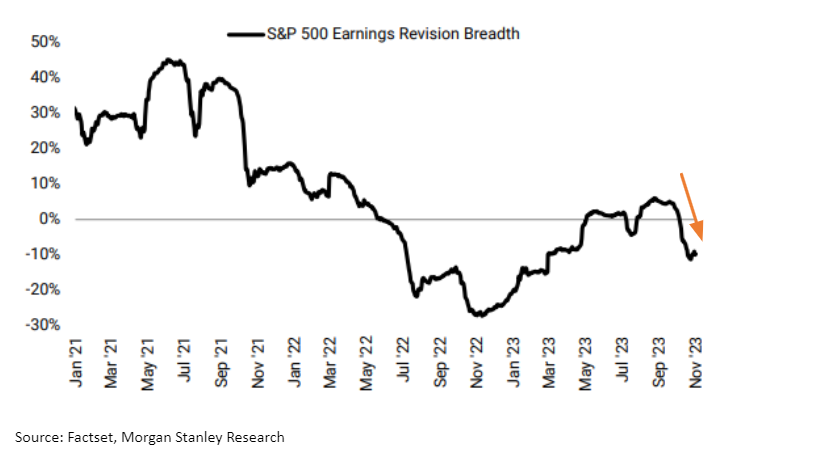

Stocks reflect these earnings revisions quickly as they are indicators of future earnings power. The steep downturn during earnings is similar to October of last year when the market also fell.

Higher bond yields also weighed on equities. Yields on 10-year U.S. Treasuries increased 36 basis points in August to 4.9%, just shy of their 46 basis point lift in September.

As we’ve noted previously, higher rates weigh on equities as stock prices reflect estimates of future earnings power. When future earnings are discounted back to today at higher rates they are less valuable.

Overall, the Fed’s message is finally being heard. Tighter financial conditions are impacting both stocks and the real world where higher interest rates are impacting auto loans, credit cards, and overall business conditions.

The question is, where does it end? So far, the impact in the real world has been manageable. The economy is slowing but not decelerating rapidly. Jobs remain plentiful, just not as plentiful as they have been. Equity markets have digested a lot in the last few months and look oversold short term. Earnings season ends soon and there will not be the same level of bad news flow. Additionally, bad news will eventually become good news to the market in anticipation of Fed easing.

While all of this will affect equities in the very short term, the bigger question remains the path of longer-duration rates and earnings for 2024. Rates remain a difficult call because even in a recession the U.S. 10-year rates could stay high as investors look to fiscal spending, Debt/GDP, and ballooning deficits.

Consensus earnings growth for 2024 is 10%. While achievable, this does not give much weight to the possibility of recession. Should that occur, there may be more downside.

On the positive side, while headline indexes like S&P 500 still appear expensive at nearly 20x, there are areas such as utilities, REITs, staples, and small caps that are getting interesting.

Please call with any thoughts or questions

Are you interested in making portfolio changes or getting a more in-depth analysis? Contact Stableford today by calling 480.493.2300 or simply request a copy of our Market Blast.

This market commentary was written and produced by Stableford Capital, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested in directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX: The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure the performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.