Stableford Market Commentary: January 2020

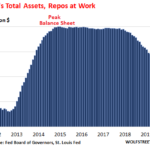

The S&P 500 declined 1.9% during January, though it hit an all-time high on January 22 and has bounced to similar levels as of February 5. The run-up to all-time highs is largely explained by the Fed’s stealth Quantitative Easing (QE) program, as well as anticipation of better economic conditions following the détente in the US-Sino trade war.